OpenAI shunned advisers on $1.5tn of deals

NeutralFinancial Markets

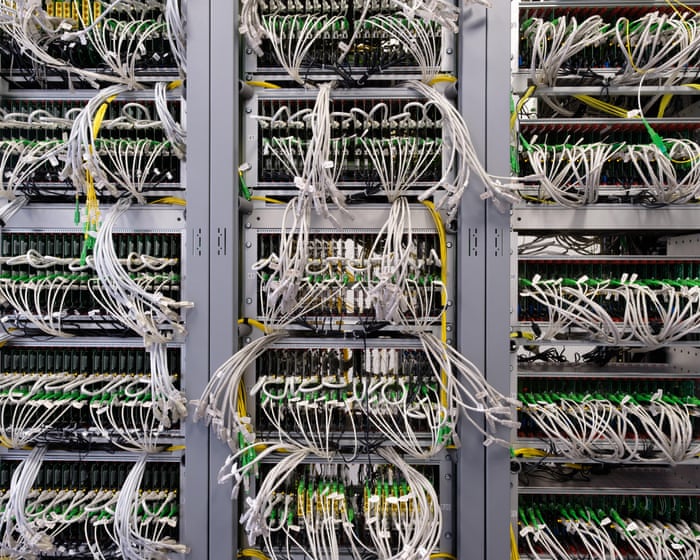

OpenAI's CEO Sam Altman has chosen to rely on a select group of in-house dealmakers instead of traditional bankers and lawyers for structuring significant infrastructure agreements worth $1.5 trillion. This approach highlights a shift in how major deals are negotiated in the tech industry, emphasizing internal expertise over external advisors. It matters because it could set a precedent for other companies to follow suit, potentially reshaping the landscape of corporate deal-making.

— Curated by the World Pulse Now AI Editorial System