US Treasuries Surge After ADP Report Shows Labor Weakness

PositiveFinancial Markets

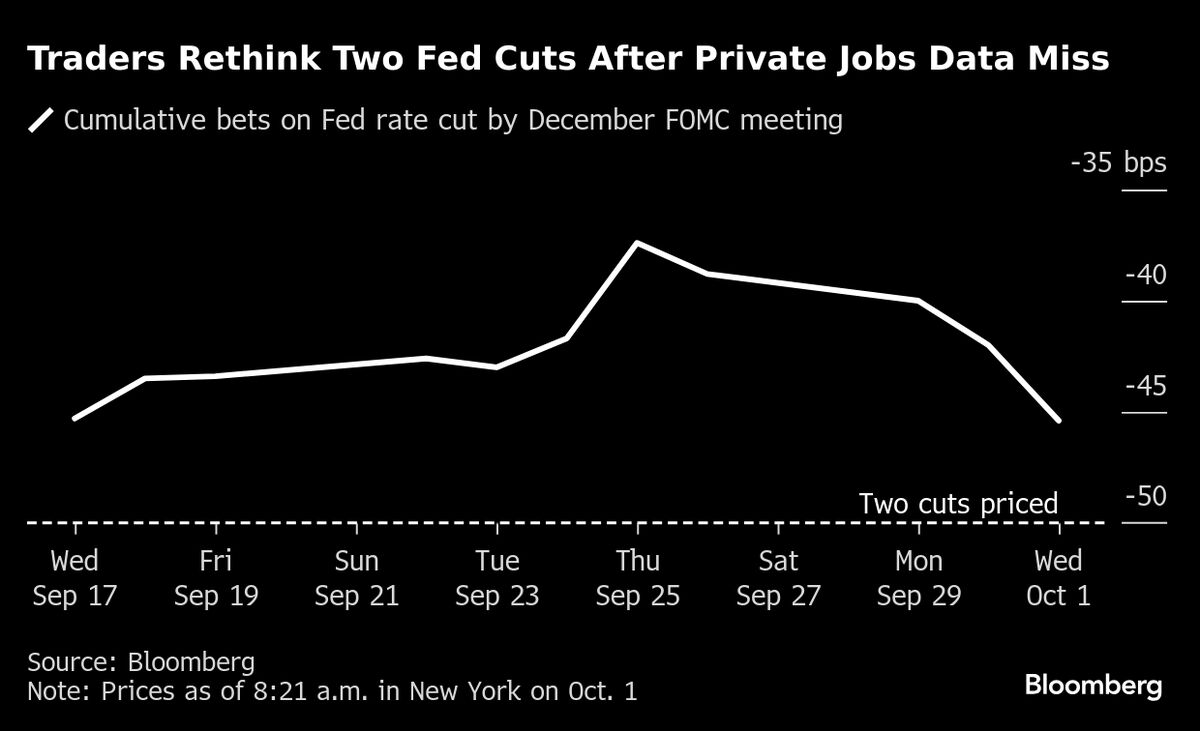

US Treasuries saw a significant surge following the latest ADP report, which indicated a sharp decline in private sector jobs. This development has prompted traders to increase their expectations for interest-rate cuts by the Federal Reserve later this year. The implications of this trend are crucial as it reflects the market's response to economic indicators, potentially influencing borrowing costs and investment strategies.

— Curated by the World Pulse Now AI Editorial System