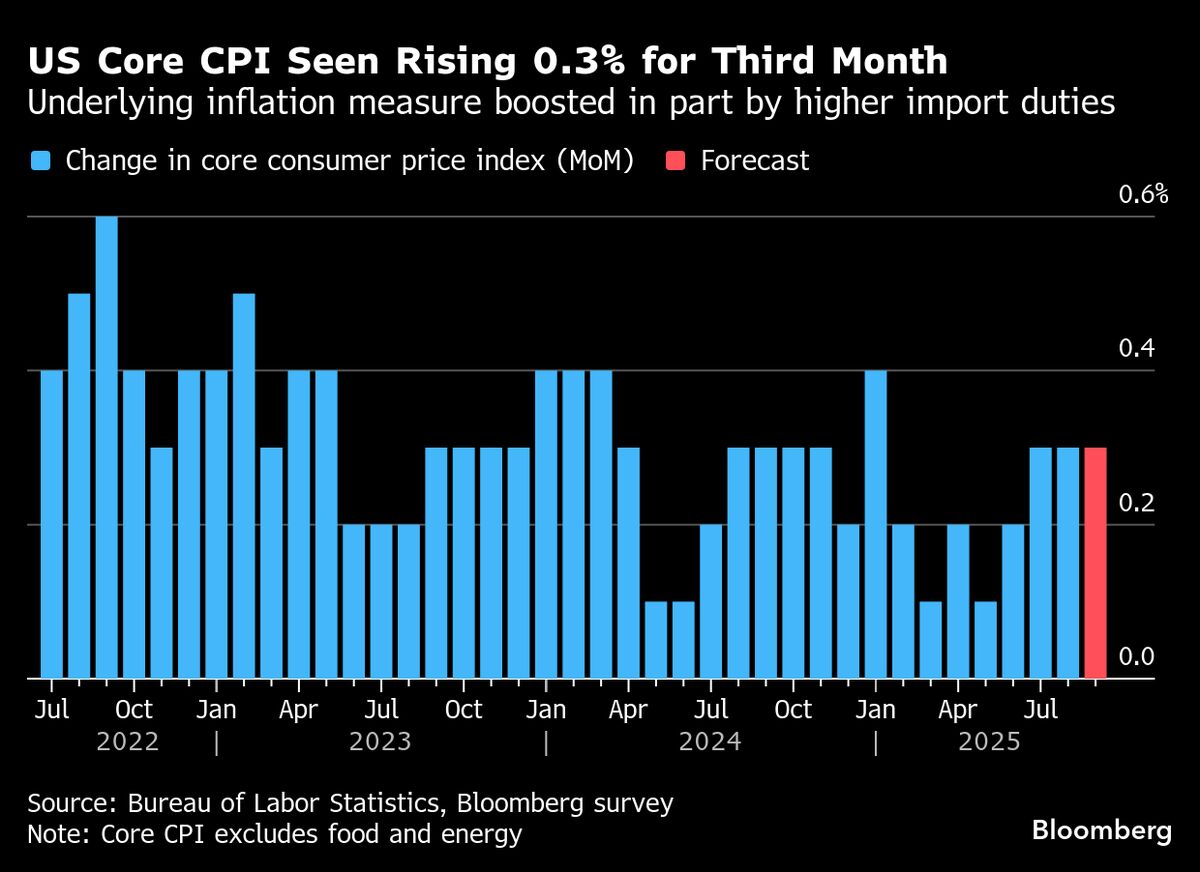

Stocks Hit Highs as CPI Gives Fed All-Clear to Cut: Markets Wrap

PositiveFinancial Markets

Wall Street experienced a significant relief rally as recent inflation data came in cooler than expected, boosting traders' confidence that the Federal Reserve may soon cut interest rates. This positive shift in the market is crucial as it suggests a more favorable economic environment, potentially leading to increased investment and consumer spending.

— Curated by the World Pulse Now AI Editorial System