ECB’s Kazaks Sees Rates Staying at 2% If No Further Shocks

NeutralFinancial Markets

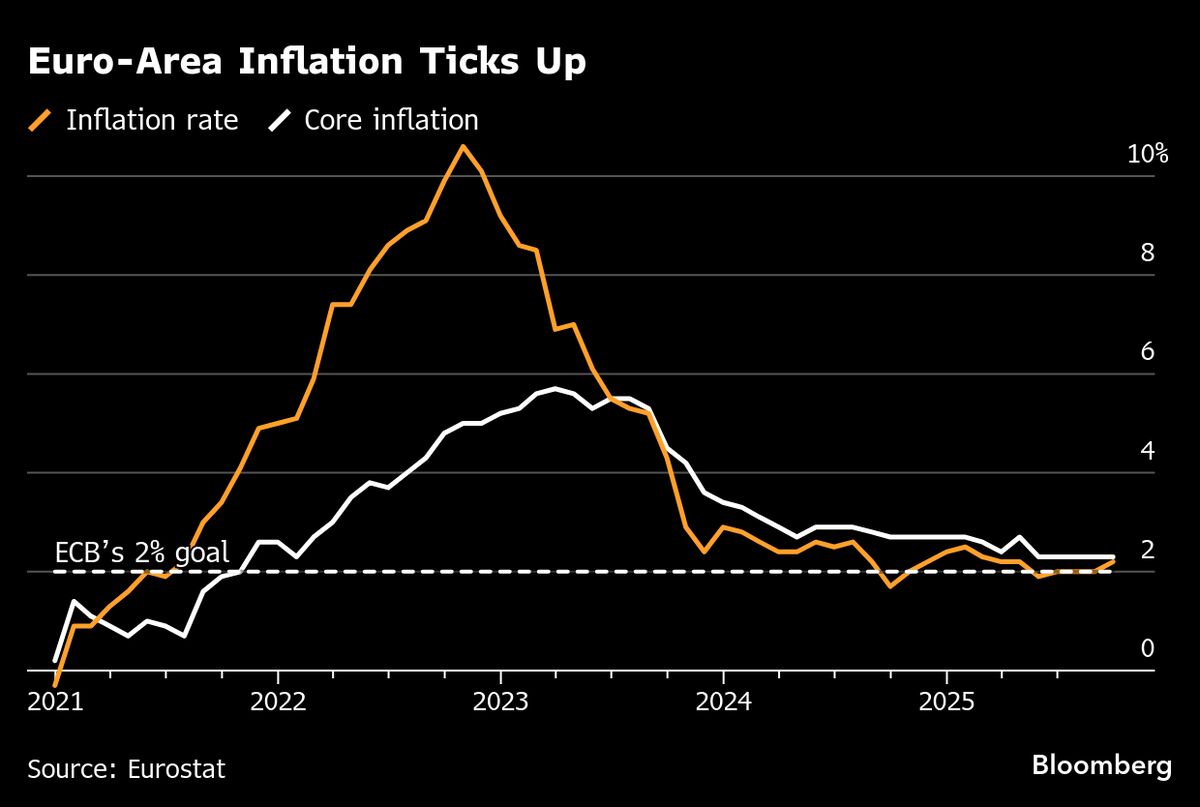

Martins Kazaks, a member of the European Central Bank's Governing Council, has indicated that interest rates are likely to remain at 2% unless the economy faces additional shocks. This statement is significant as it reflects the ECB's cautious approach to monetary policy amid ongoing economic uncertainties, providing insight into future financial conditions for businesses and consumers.

— Curated by the World Pulse Now AI Editorial System