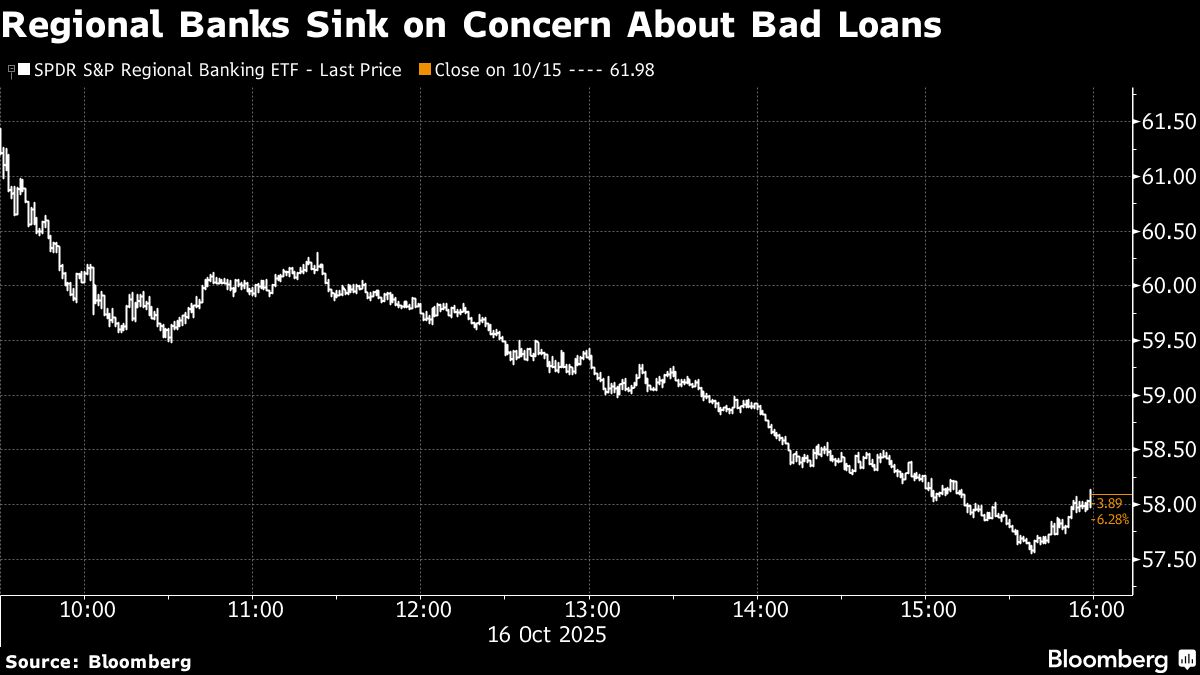

Asian Stocks to Fall as Credit Woes Sap Sentiment: Markets Wrap

NegativeFinancial Markets

Asian stocks are expected to open lower as concerns about bad loans at two US banks have dampened risk sentiment on Wall Street. This situation is significant as it reflects growing worries about the stability of the credit market, which could have broader implications for global financial stability.

— Curated by the World Pulse Now AI Editorial System