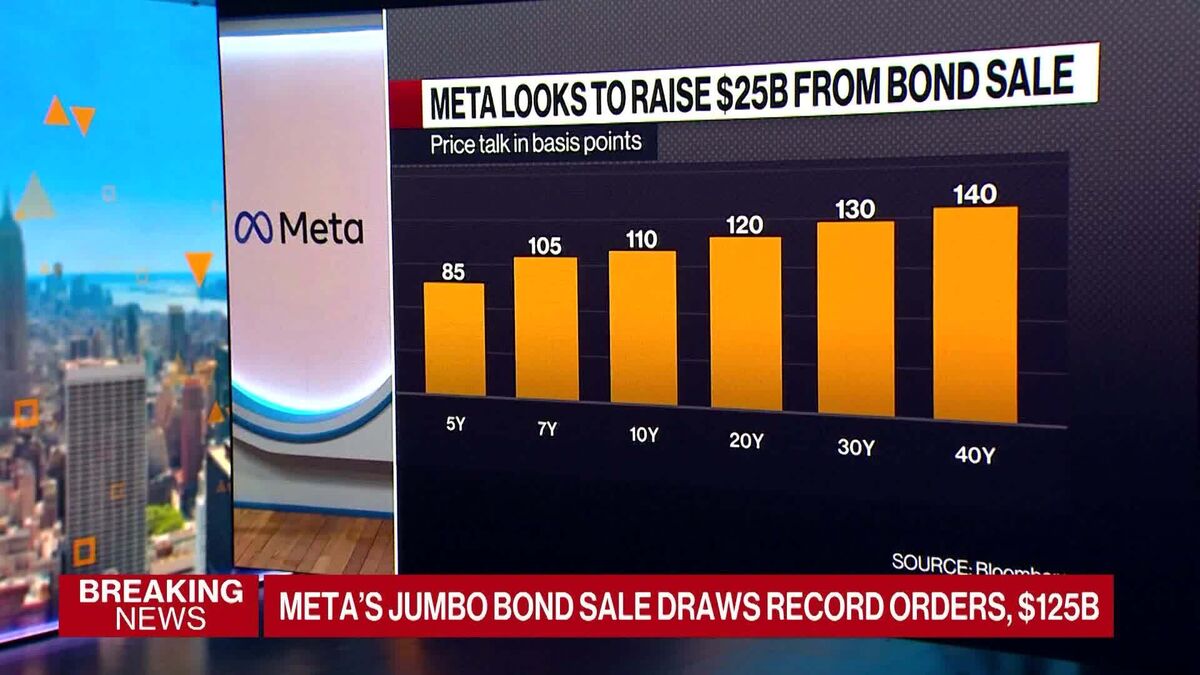

Meta Jumbo Bond Sale Seeks to Raise at Least $25 Billion

PositiveFinancial Markets

Meta is making headlines with its ambitious plan to raise at least $25 billion through a bond sale, which could significantly bolster its financial position. This move, involving a dollar-bond sale structured in up to six parts with varying maturities, reflects Meta's confidence in its long-term strategy and market conditions. It's a noteworthy development for investors and the tech industry, as it showcases Meta's commitment to growth and innovation.

— Curated by the World Pulse Now AI Editorial System