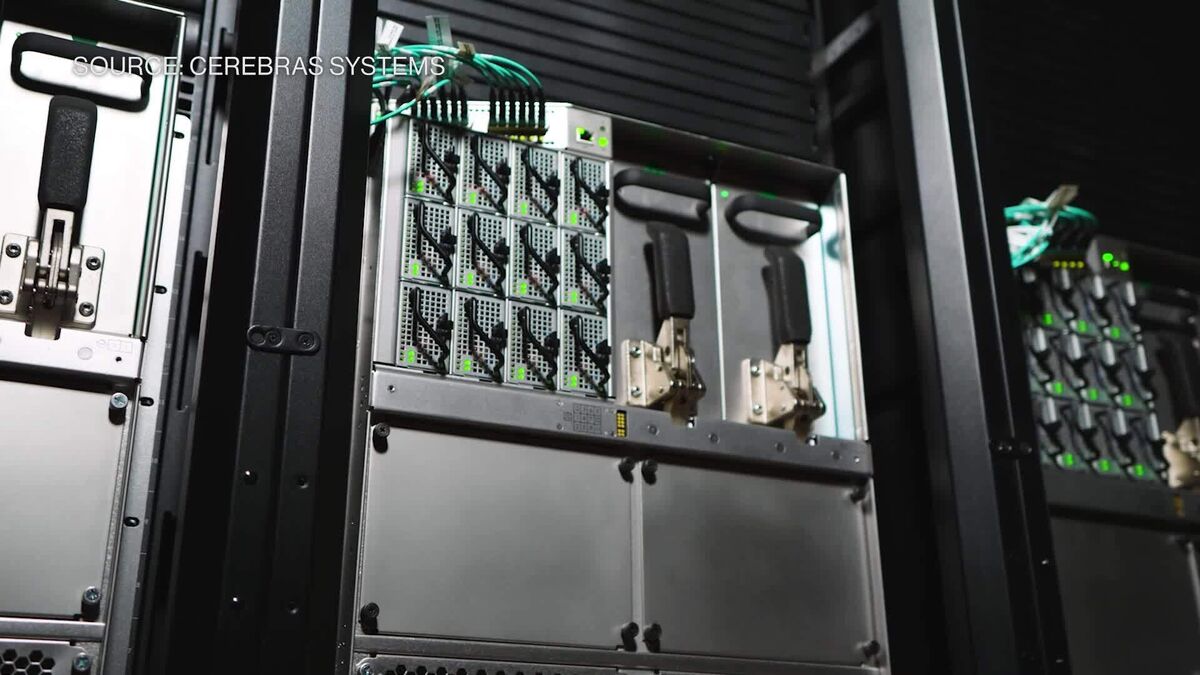

AI Chip Maker Cerebras Systems Raises $1.1 Billion

PositiveFinancial Markets

Cerebras Systems has successfully raised $1.1 billion in its latest funding round, a significant boost that CEO Andrew Feldman believes will propel the company's ambitions for an IPO. This funding not only highlights the growing interest in AI technology but also positions Cerebras as a key player in the semiconductor industry, potentially leading to advancements in AI chip development. The implications of this funding are vast, as it could accelerate innovation and competition in the tech sector.

— Curated by the World Pulse Now AI Editorial System