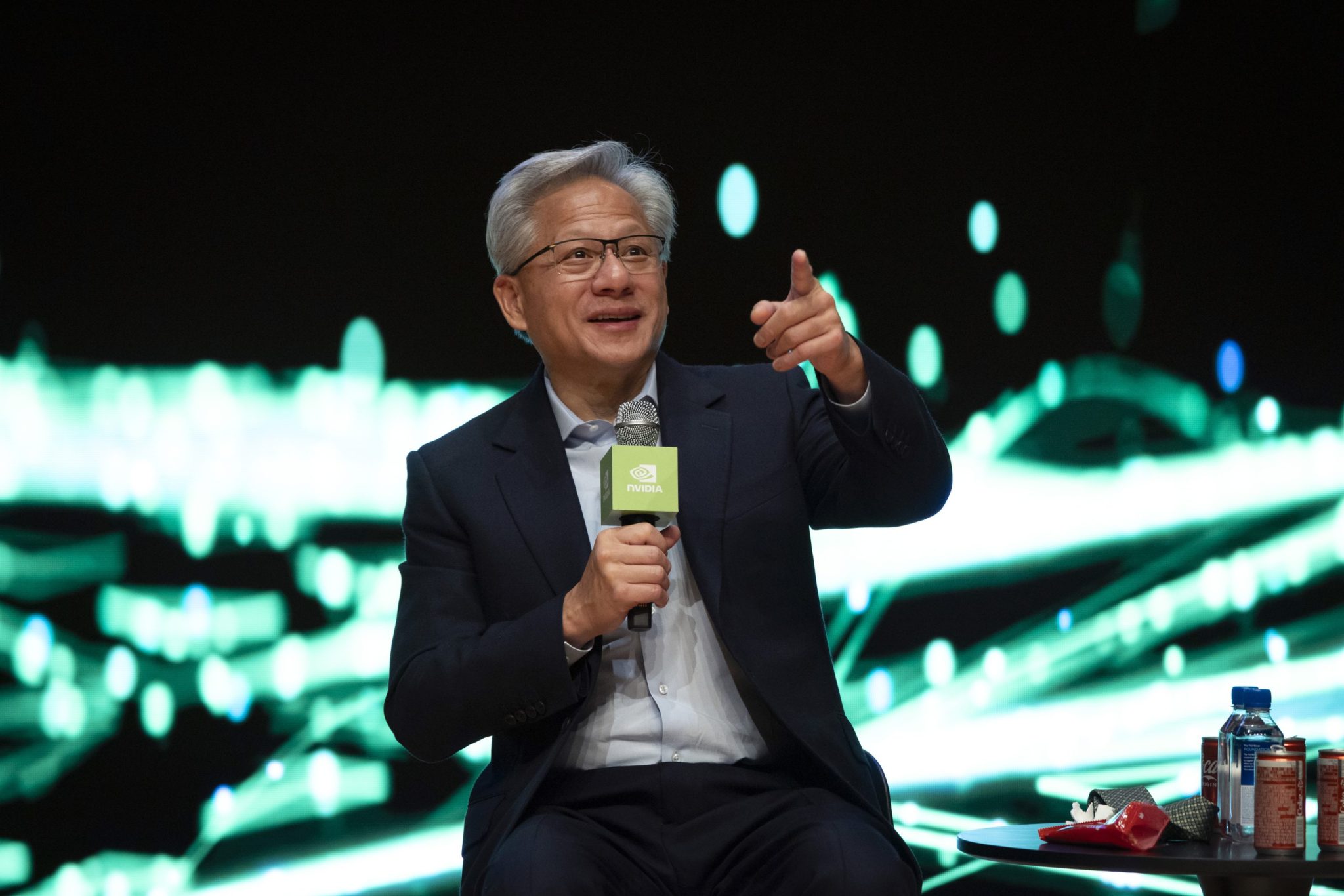

Nvidia’s China Future Remains Unclear

NeutralFinancial Markets

In a recent discussion on Bloomberg Tech, Amy Webb, CEO of Future Today Strategy Group, highlighted the ongoing technology tensions between the US and China following a meeting between their leaders. This conversation is crucial as it sheds light on the uncertain future of companies like Nvidia in the Chinese market, which could have significant implications for global tech dynamics.

— Curated by the World Pulse Now AI Editorial System