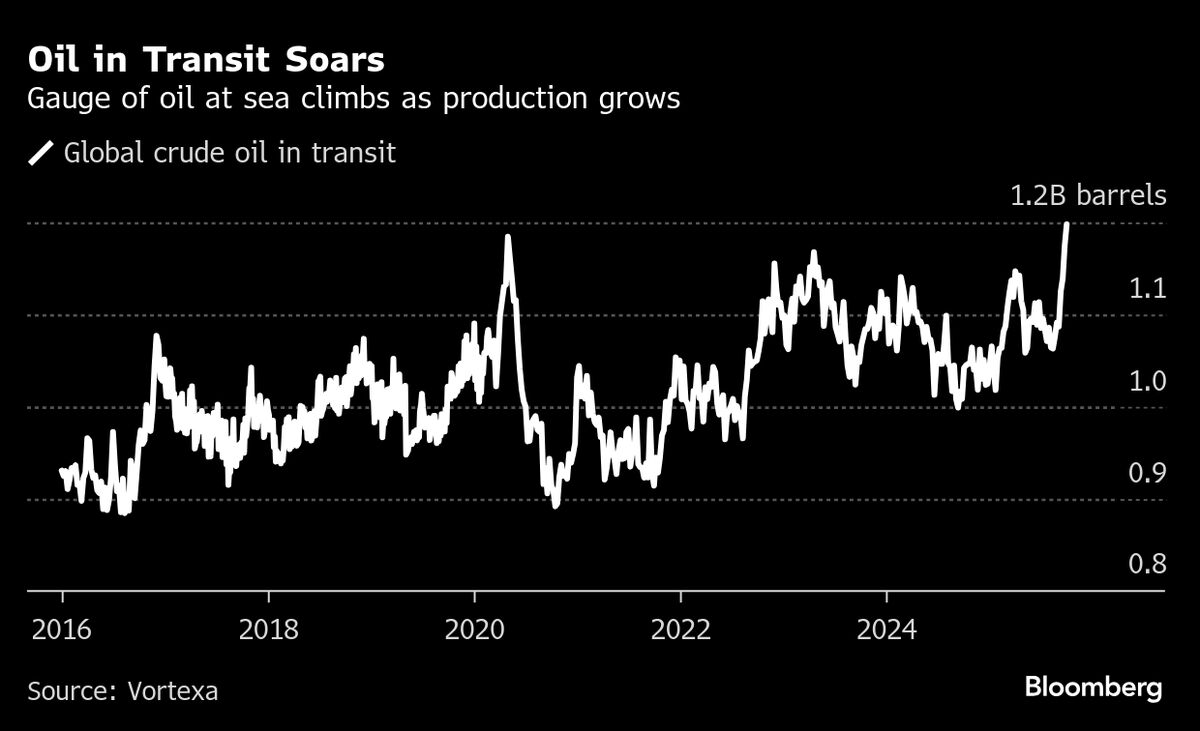

Oil prices hold gains as traders weigh modest OPEC+ output hike

NeutralFinancial Markets

Oil prices are maintaining their recent gains as traders assess a modest increase in output from OPEC+. This development is significant as it reflects the ongoing balancing act within the oil market, where supply adjustments can impact global prices and economic stability. Investors are closely monitoring these changes to gauge future trends in energy costs.

— Curated by the World Pulse Now AI Editorial System