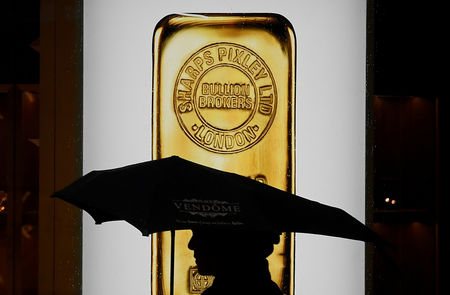

Goldman Sachs raises its gold price target to $4,900 by end-2026

PositiveFinancial Markets

Goldman Sachs has raised its gold price target to an impressive $4,900 by the end of 2026, signaling strong confidence in the precious metal's future value. This adjustment reflects the bank's analysis of economic trends and market conditions, suggesting that investors may want to consider gold as a solid investment option in the coming years. Such a significant price forecast could influence market dynamics and investor behavior, making it a noteworthy development in the financial landscape.

— Curated by the World Pulse Now AI Editorial System