Future of Ovo Energy in doubt after failing financial stress tests

NegativeFinancial Markets

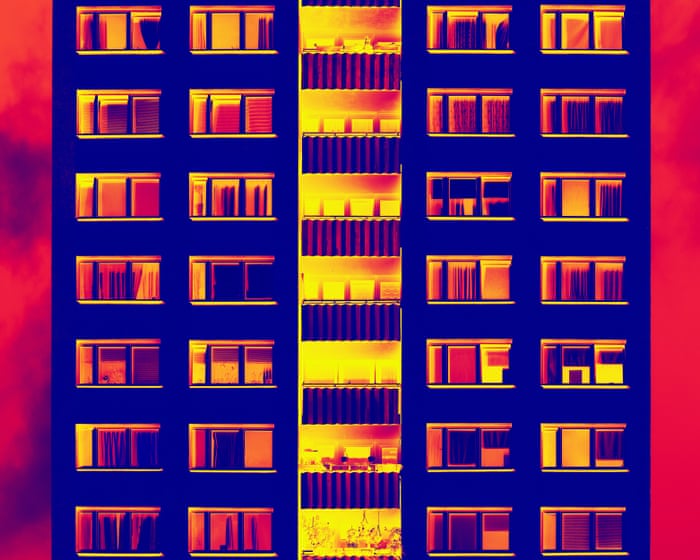

Ovo Energy, one of Great Britain's largest domestic gas and electricity suppliers, is facing uncertainty about its future after failing to meet financial stress tests set by regulators. Founded by green energy entrepreneur Stephen Fitzpatrick, the company has acknowledged challenges in improving its capital position. This situation is significant as it raises concerns about the stability of energy supply in the UK, especially amid ongoing discussions about the transition to greener energy sources.

— Curated by the World Pulse Now AI Editorial System