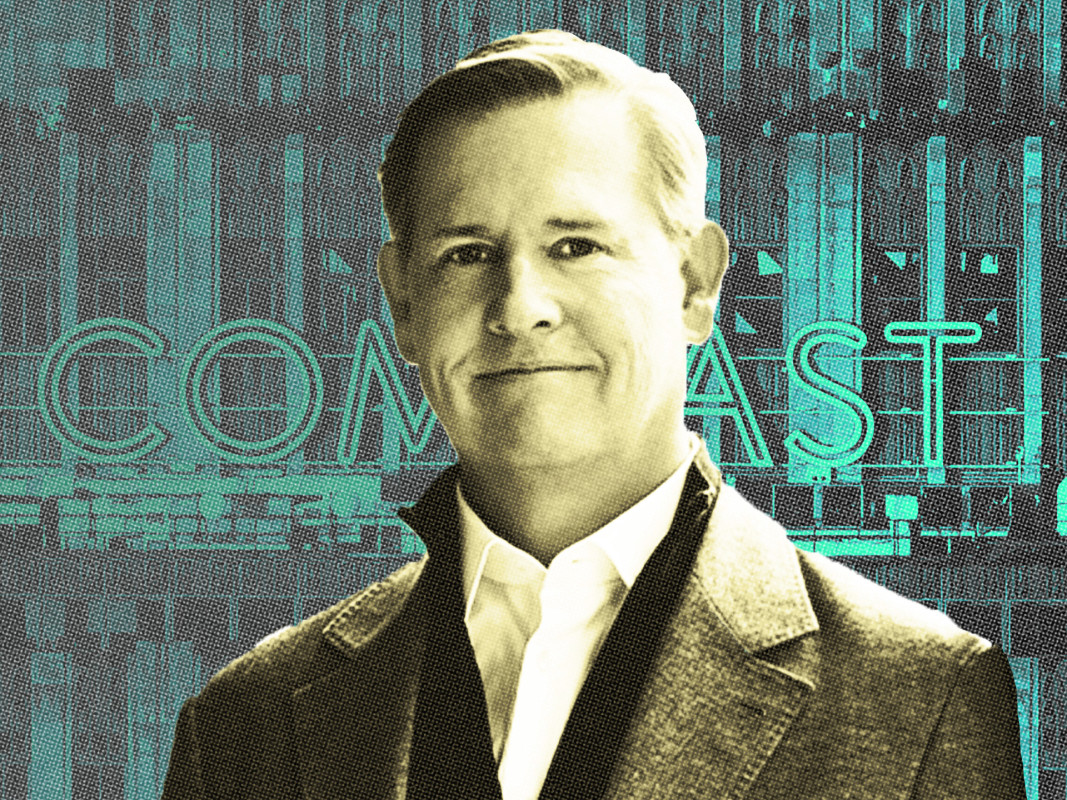

Seaport Global downgrades Comcast stock rating to Neutral from Buy

NegativeFinancial Markets

Seaport Global has downgraded Comcast's stock rating from Buy to Neutral, signaling a shift in confidence regarding the company's future performance. This change is significant as it reflects analysts' concerns about Comcast's ability to maintain growth in a competitive market, which could impact investor sentiment and stock value.

— Curated by the World Pulse Now AI Editorial System