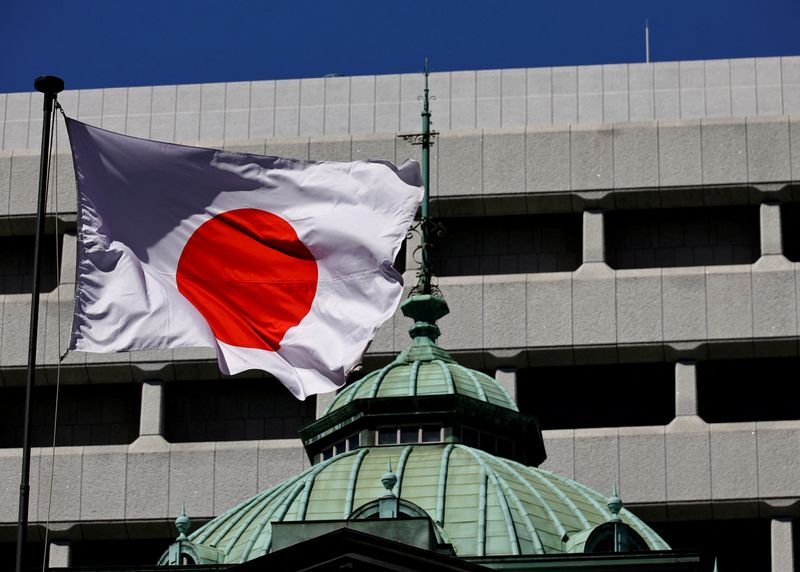

Dollar steadies amid U.S. government shutdown, political upheaval in Europe, Japan

NeutralFinancial Markets

The dollar has stabilized despite ongoing challenges such as the U.S. government shutdown and political turmoil in Europe and Japan. This situation is significant as it reflects the resilience of the dollar in the face of global uncertainties, which can impact international trade and investment.

— Curated by the World Pulse Now AI Editorial System