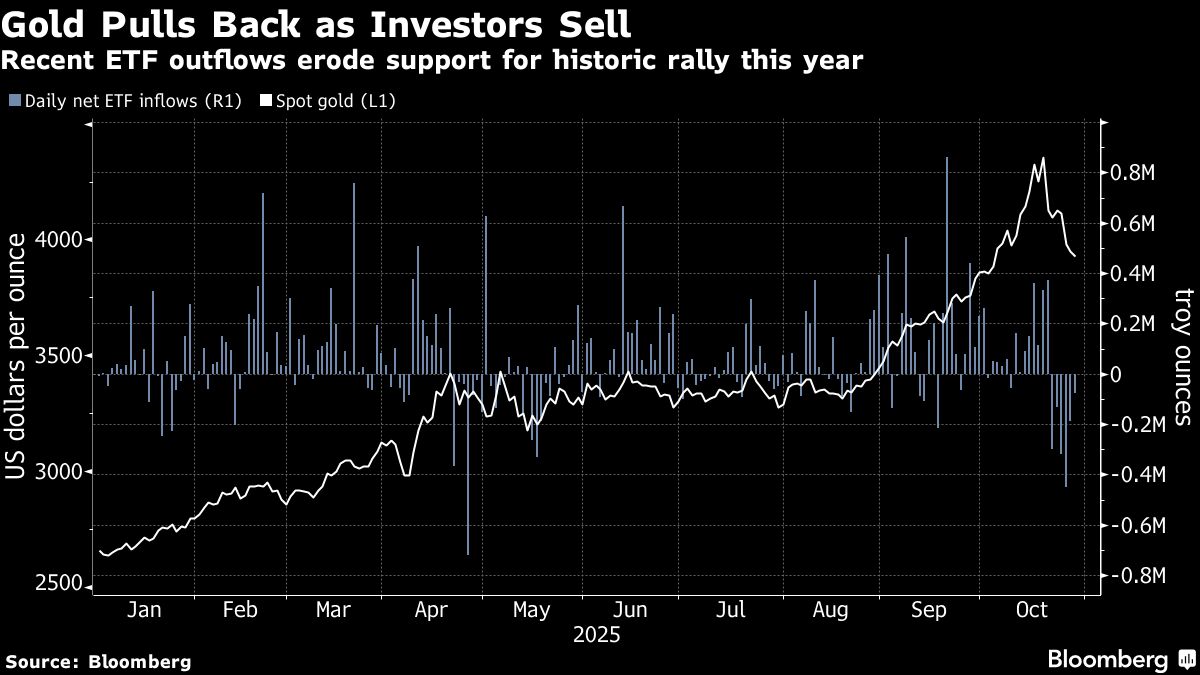

The key price to watch before buying gold and silver

NeutralFinancial Markets

Investors should keep an eye on a specific price point that could indicate the next opportunity to buy gold and silver. Understanding these price signals is crucial for making informed investment decisions in precious metals, especially in a fluctuating market.

— Curated by the World Pulse Now AI Editorial System