How a Silicon Valley ’warlord’ got the Pentagon’s attention

PositiveFinancial Markets

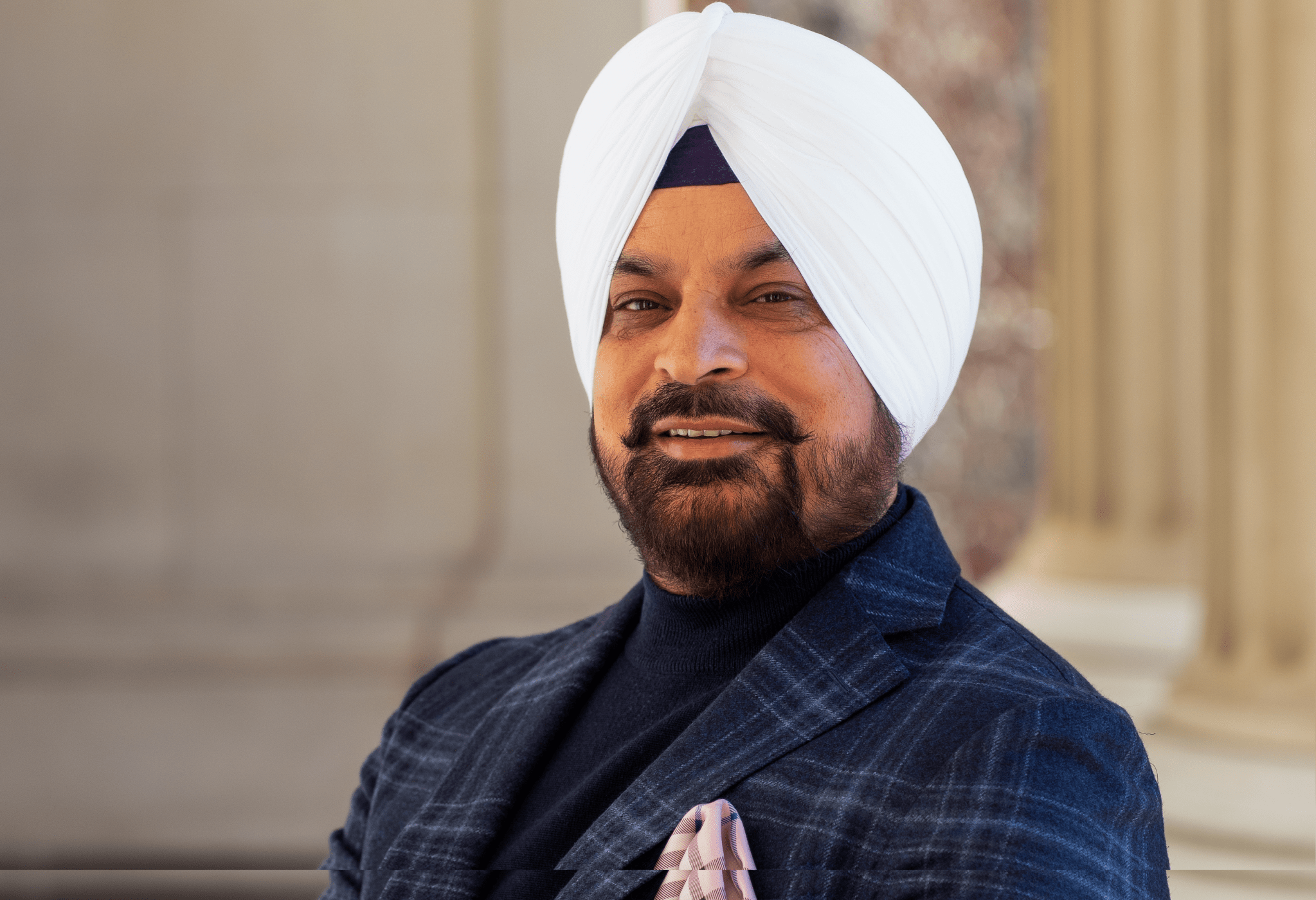

A Silicon Valley entrepreneur has captured the Pentagon's attention with innovative technology solutions aimed at enhancing national defense. This development is significant as it highlights the growing collaboration between tech startups and government agencies, potentially leading to advancements in military capabilities and national security.

— Curated by the World Pulse Now AI Editorial System