Dollar strengthens as traders process trade talks and Fed

PositiveFinancial Markets

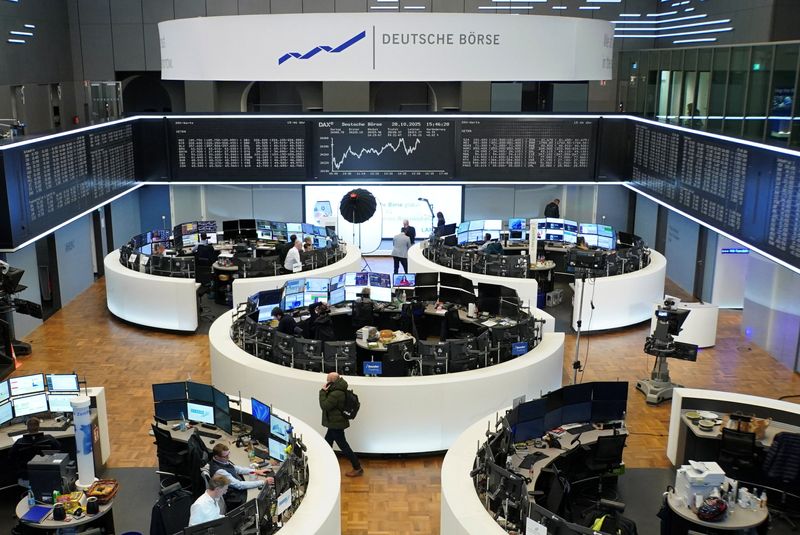

The dollar has gained strength as traders react to ongoing trade discussions and insights from the Federal Reserve. This development is significant as it reflects market confidence and could influence global economic dynamics, making it a key point for investors and policymakers alike.

— Curated by the World Pulse Now AI Editorial System