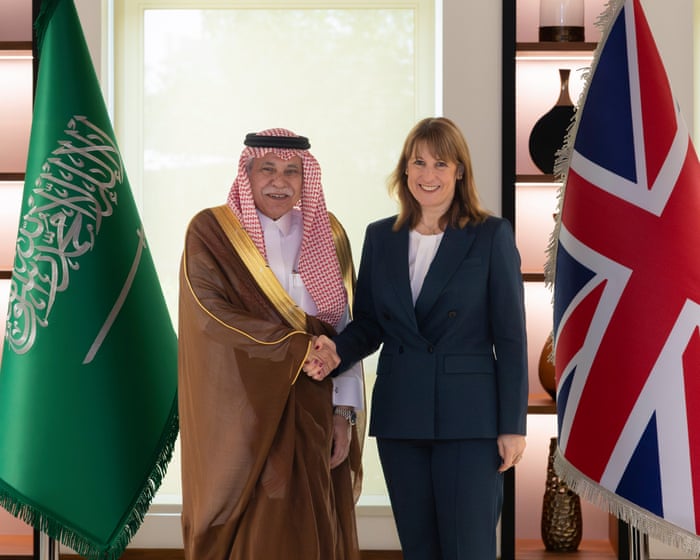

Rachel Reeves is the face of this budget. But the really big decisions are not in Labour’s hands | Larry Elliott

NeutralFinancial Markets

As the UK prepares for its upcoming budget, Rachel Reeves is positioned as a key figure, yet the real power lies with the Office for Budget Responsibility and the Bank of England. This situation highlights a critical need for reevaluation of how economic policies are shaped, as the decisions that impact the nation's finances are increasingly removed from direct political influence. Understanding this dynamic is essential for grasping the broader implications of fiscal policy in the UK.

— Curated by the World Pulse Now AI Editorial System