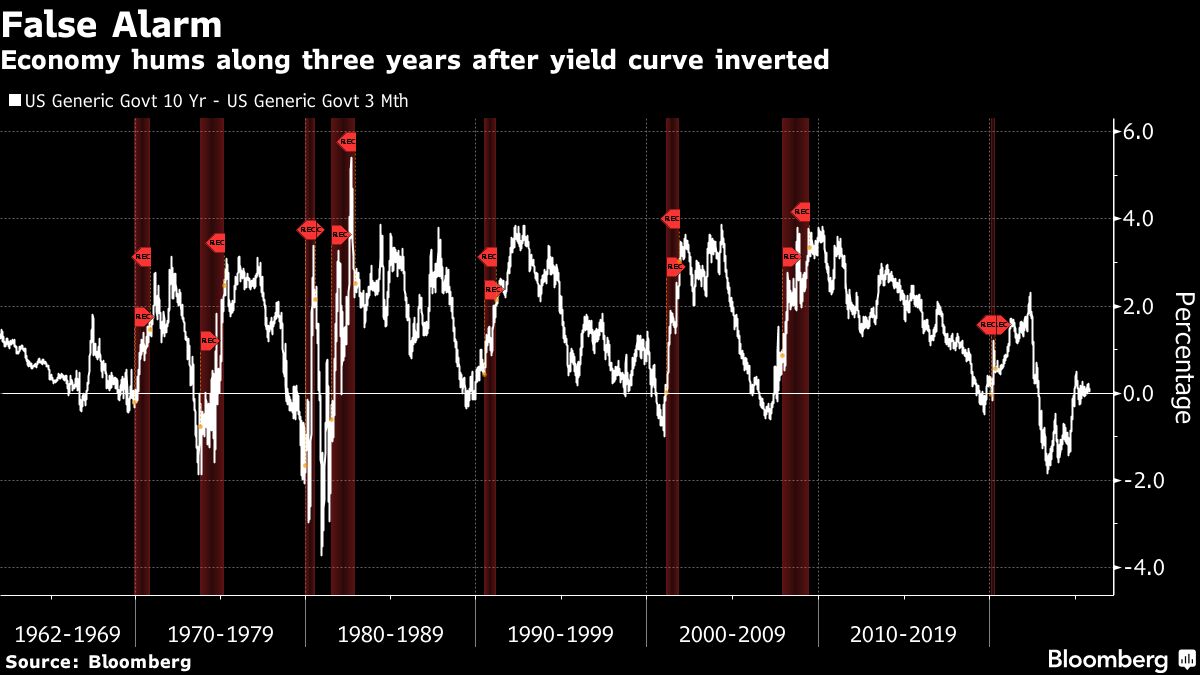

The Bond Market’s Favorite Recession Signal Is on the Fritz

NeutralFinancial Markets

The bond market, known for its reliable recession signals, hasn't indicated a false alarm in over fifty years. This unusual stability raises questions about the current economic landscape and what it means for future predictions. Investors and analysts are closely monitoring these trends, as they could impact financial strategies and economic policies moving forward.

— Curated by the World Pulse Now AI Editorial System