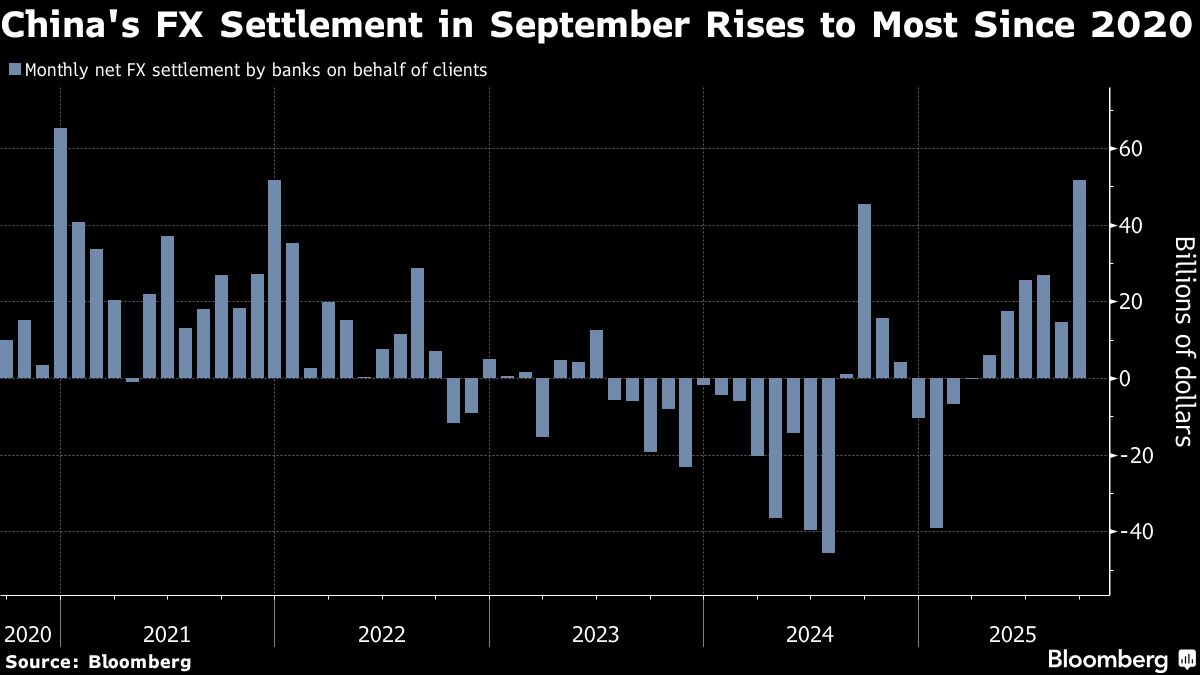

Chinese Firms Speed up Dollar Selling Amid Optimism Toward Yuan

PositiveFinancial Markets

Chinese banks are rapidly assisting clients in selling off overseas currencies, marking the fastest pace since 2020. This surge in dollar selling reflects a growing optimism about the yuan's potential for appreciation, which could have significant implications for the Chinese economy and global markets. As confidence in the yuan strengthens, it may lead to increased investments and a more favorable trade balance for China.

— Curated by the World Pulse Now AI Editorial System