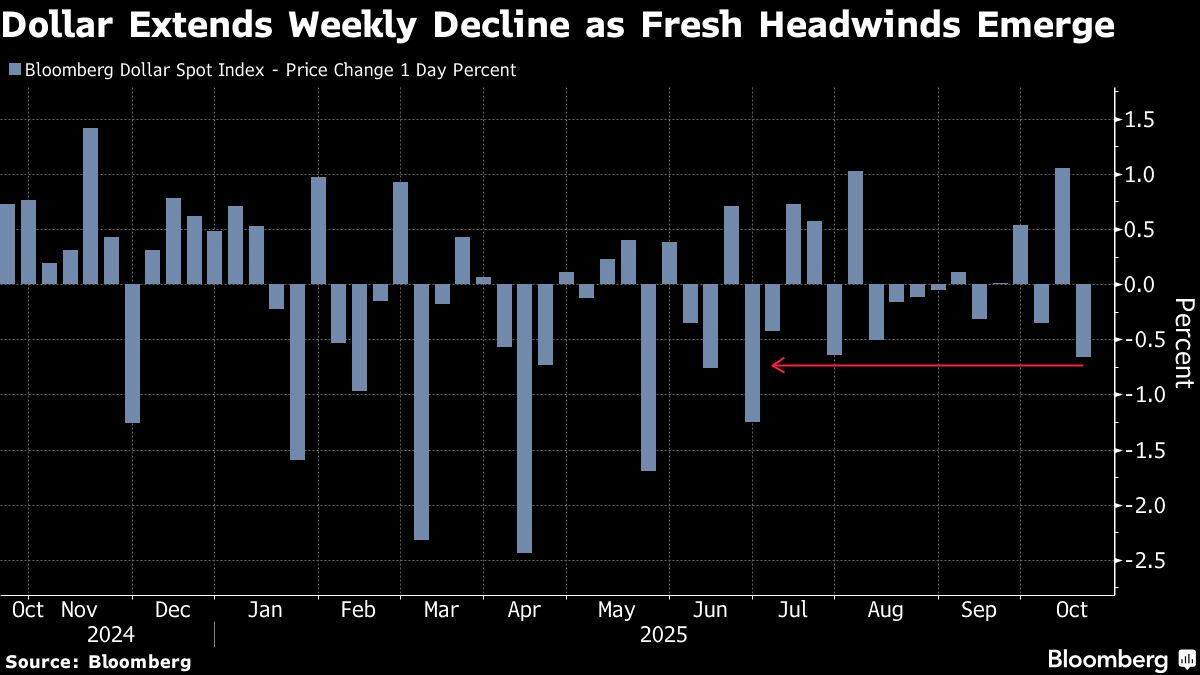

Dollar Set for Worst Week Since June on Fed Bets, Bank Woes

NegativeFinancial Markets

The dollar is experiencing its worst week since June, declining for four consecutive days due to dovish signals from Federal Reserve officials and growing concerns about US regional banks. This significant drop highlights the impact of monetary policy on currency strength and raises questions about the stability of the banking sector, which could have broader implications for the economy.

— Curated by the World Pulse Now AI Editorial System