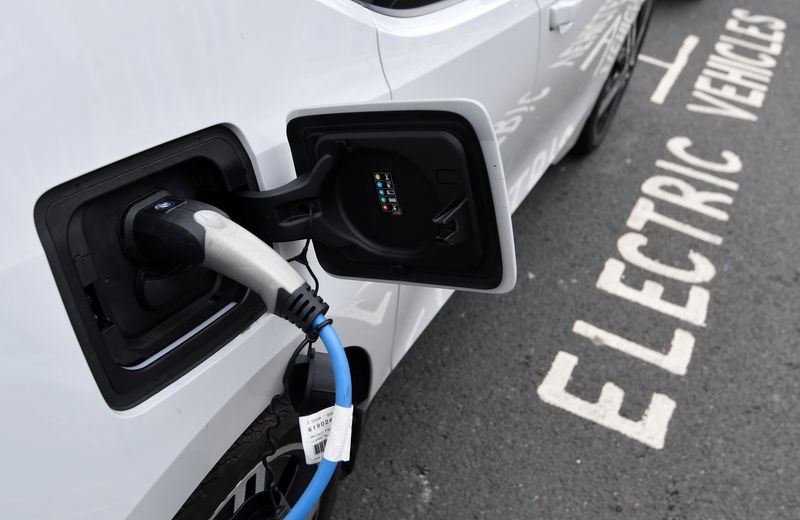

Global EV sales hit record 2.1 million in September, research firm says

PositiveFinancial Markets

In a remarkable achievement, global electric vehicle (EV) sales reached a record 2.1 million units in September, according to a research firm. This surge in sales highlights the growing acceptance and demand for electric vehicles as consumers increasingly prioritize sustainability and eco-friendly options. The rise in EV sales is significant not only for the automotive industry but also for global efforts to combat climate change, making this milestone a pivotal moment in the transition to greener transportation.

— Curated by the World Pulse Now AI Editorial System