Auto Stocks in a Spin as First Brands, Tricolor Worry Investors

NegativeFinancial Markets

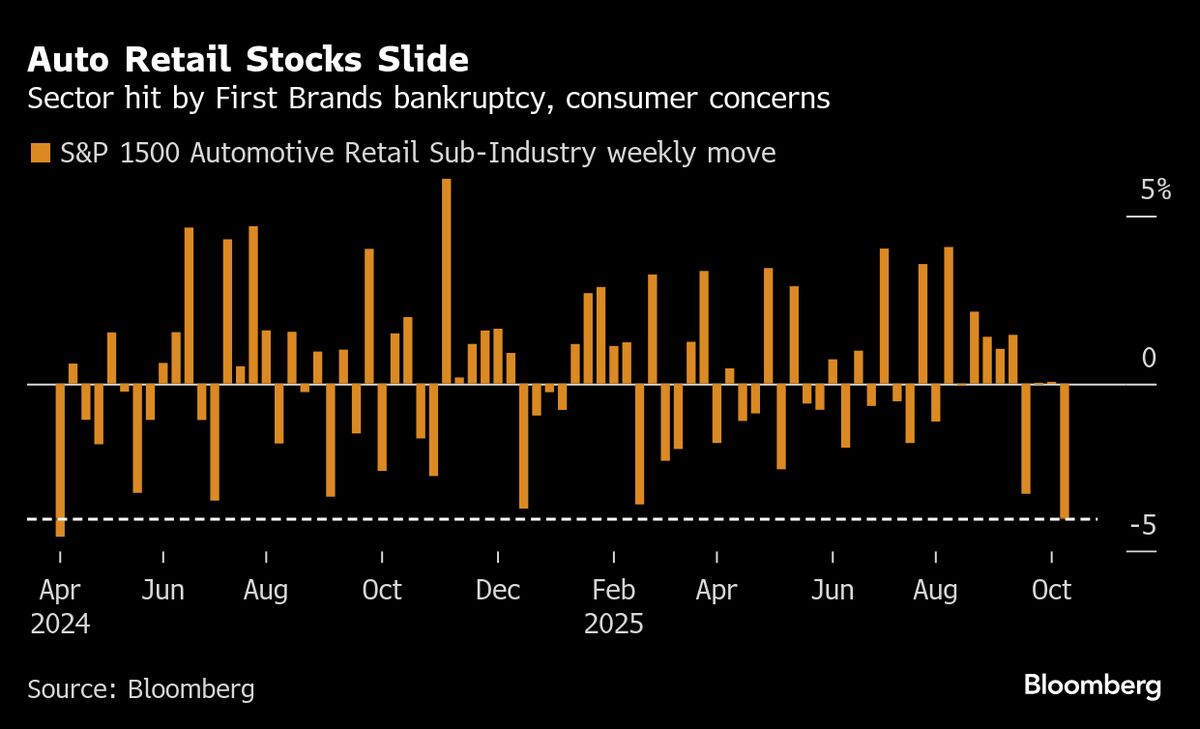

This week, US auto stocks faced a significant downturn as the collapse of parts supplier First Brands and subprime lender Tricolor Holdings raised alarms among investors. The situation is further complicated by renewed tariff tensions, which add to the uncertainty in the automotive sector. This matters because it highlights vulnerabilities in the industry and could lead to broader implications for the economy and consumer confidence.

— Curated by the World Pulse Now AI Editorial System