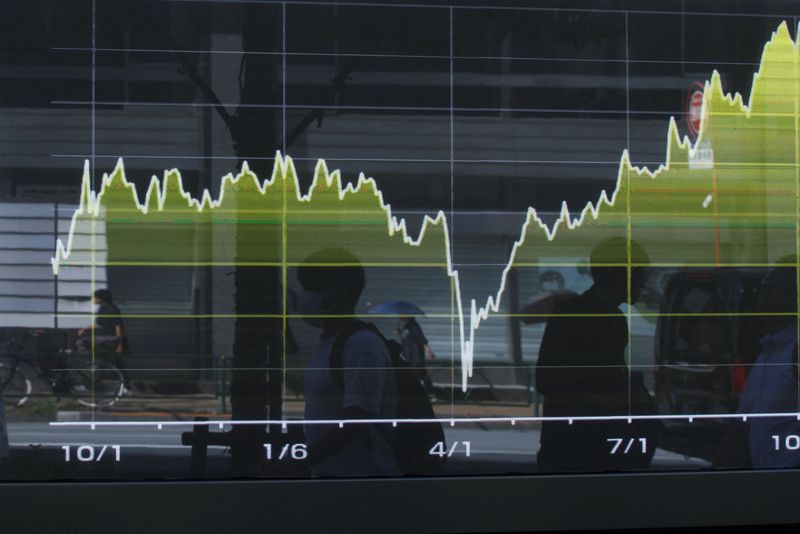

Deere stock rating upgraded to Buy at UBS on expected earnings recovery

PositiveFinancial Markets

Deere's stock has received a significant boost as UBS upgraded its rating to 'Buy', anticipating a recovery in earnings. This upgrade is important because it reflects confidence in Deere's future performance, suggesting that investors may see better returns as the company navigates market challenges. Such positive outlooks can influence investor sentiment and potentially drive stock prices higher.

— Curated by the World Pulse Now AI Editorial System