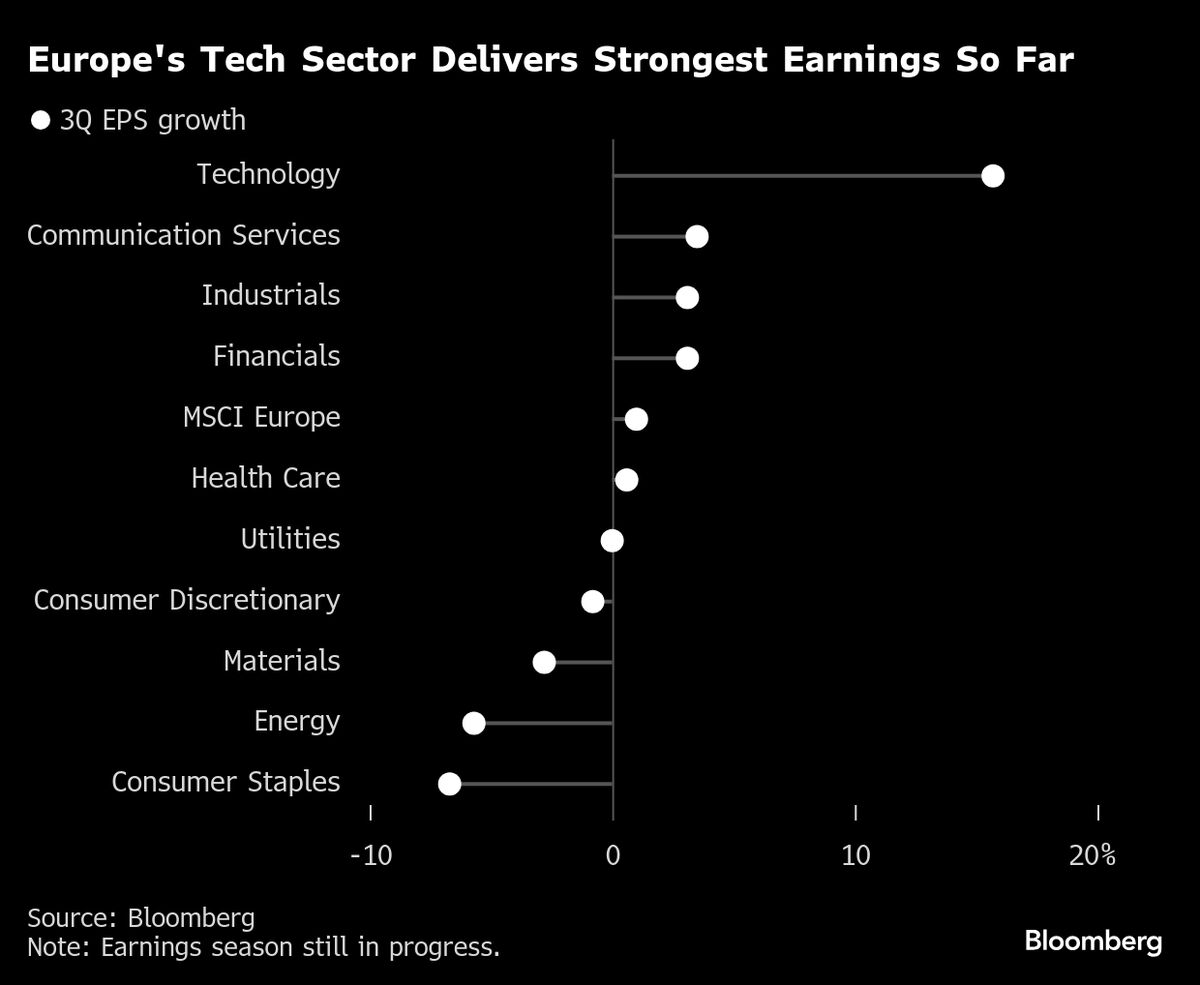

Europe’s Tech Sector Outperforms as AI Boom Bolsters Demand

PositiveFinancial Markets

Europe's tech sector is experiencing a remarkable surge, with earnings surpassing expectations thanks to a booming interest in artificial intelligence. This growth not only highlights the resilience of the industry amid trade challenges but also signals a strong future for tech investments in the region. As companies increasingly pivot towards AI, the demand is expected to continue rising, making this a pivotal moment for European innovation.

— Curated by the World Pulse Now AI Editorial System