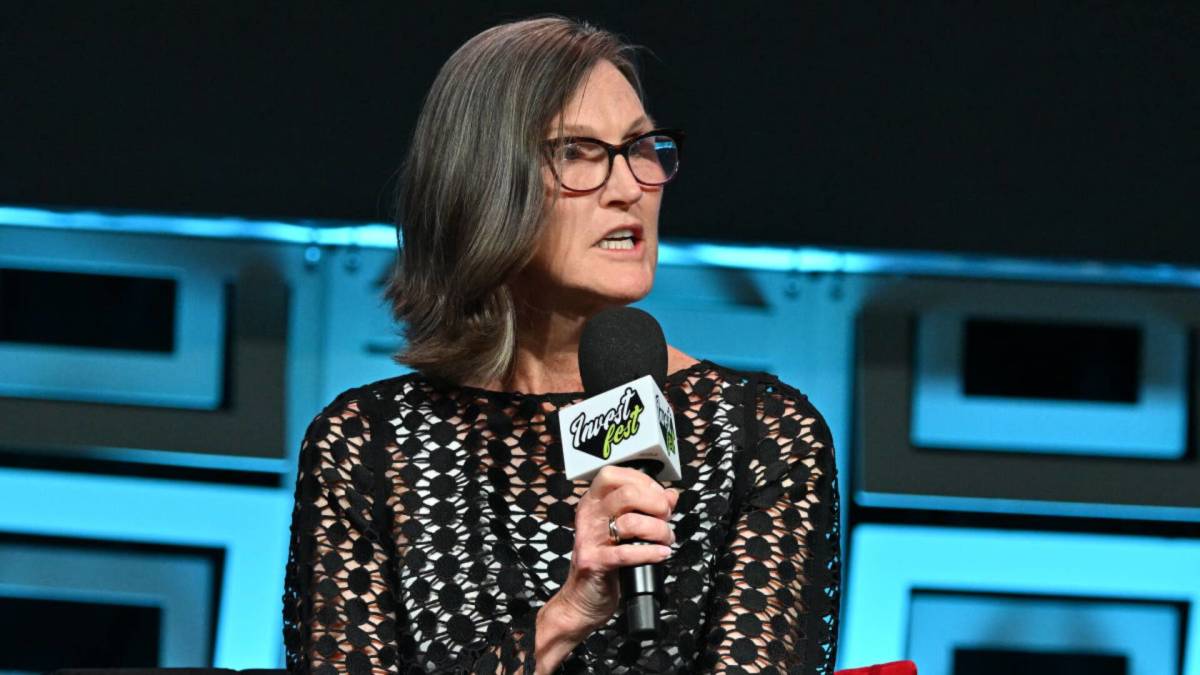

Cathie Wood's ARK ETF adjusts, buys LHX and NTLA, sells KTOS

PositiveFinancial Markets

Cathie Wood's ARK ETF has made strategic adjustments by purchasing shares in L3Harris Technologies (LHX) and Intellia Therapeutics (NTLA), while selling off its holdings in Kratos Defense & Security Solutions (KTOS). This move reflects ARK's ongoing commitment to investing in innovative companies that are poised for growth, which is particularly significant given the current market dynamics. Investors are keenly watching these changes as they may signal ARK's confidence in the future performance of LHX and NTLA.

— Curated by the World Pulse Now AI Editorial System