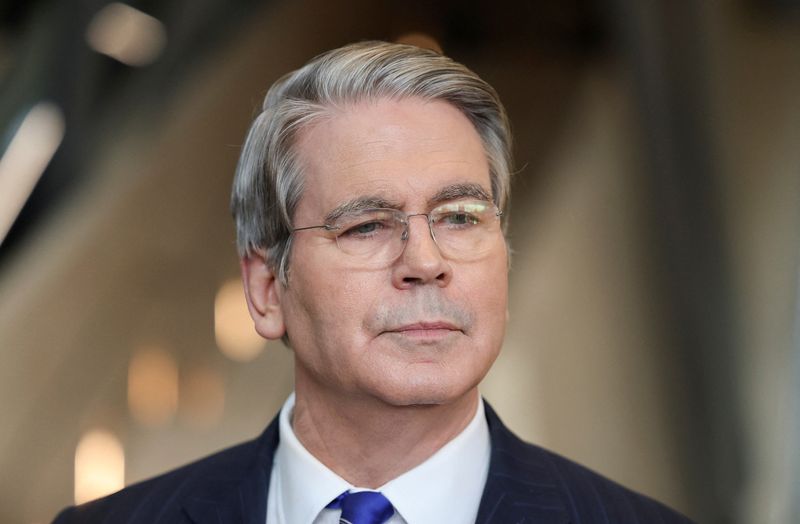

Barclays snaps up US loan firm Best Egg for $800 million

PositiveFinancial Markets

Barclays has made a significant move by acquiring the US loan firm Best Egg for $800 million. This acquisition is important as it strengthens Barclays' position in the consumer lending market, allowing them to expand their offerings and reach more customers. Best Egg is known for its innovative approach to personal loans, and this deal could enhance Barclays' portfolio and drive growth in the competitive financial landscape.

— Curated by the World Pulse Now AI Editorial System