Treasuries Rise on Signs Government Shutdown Is Hurting Economy

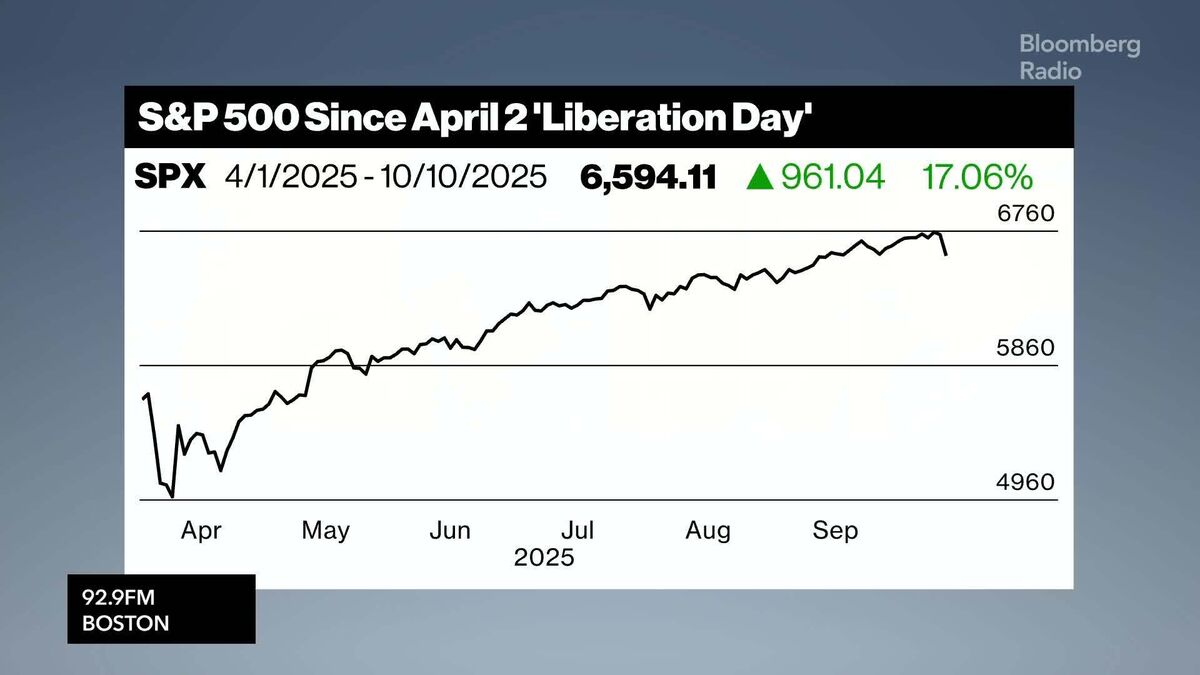

PositiveFinancial Markets

Treasuries saw an uptick on Friday as traders responded to indications that the US government shutdown is negatively impacting economic activity. This development is significant as it highlights the interconnectedness of government operations and economic health, suggesting that prolonged shutdowns could lead to broader financial implications.

— Curated by the World Pulse Now AI Editorial System