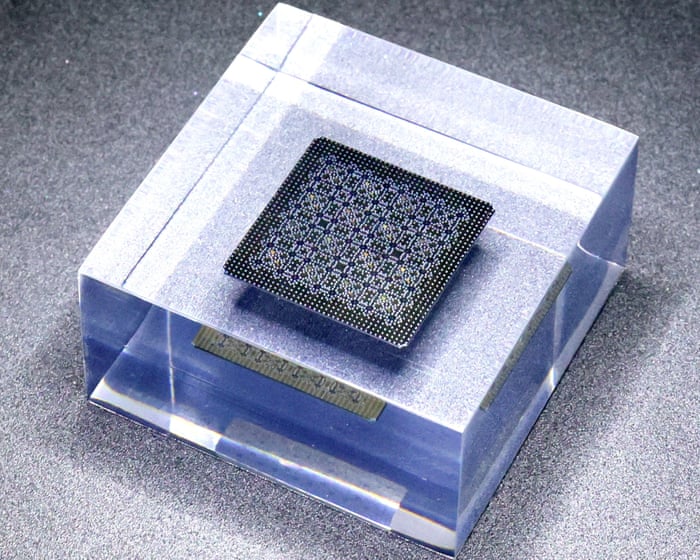

Google hails breakthrough as quantum computer surpasses ability of supercomputers

PositiveFinancial Markets

Google has announced a significant breakthrough in quantum computing, revealing that its new algorithm can perform tasks that surpass the capabilities of traditional supercomputers. This advancement could lead to groundbreaking discoveries in fields like medicine, although experts caution that practical applications may still be years away. This development is exciting as it represents a major step forward in harnessing quantum technology for real-world benefits.

— Curated by the World Pulse Now AI Editorial System