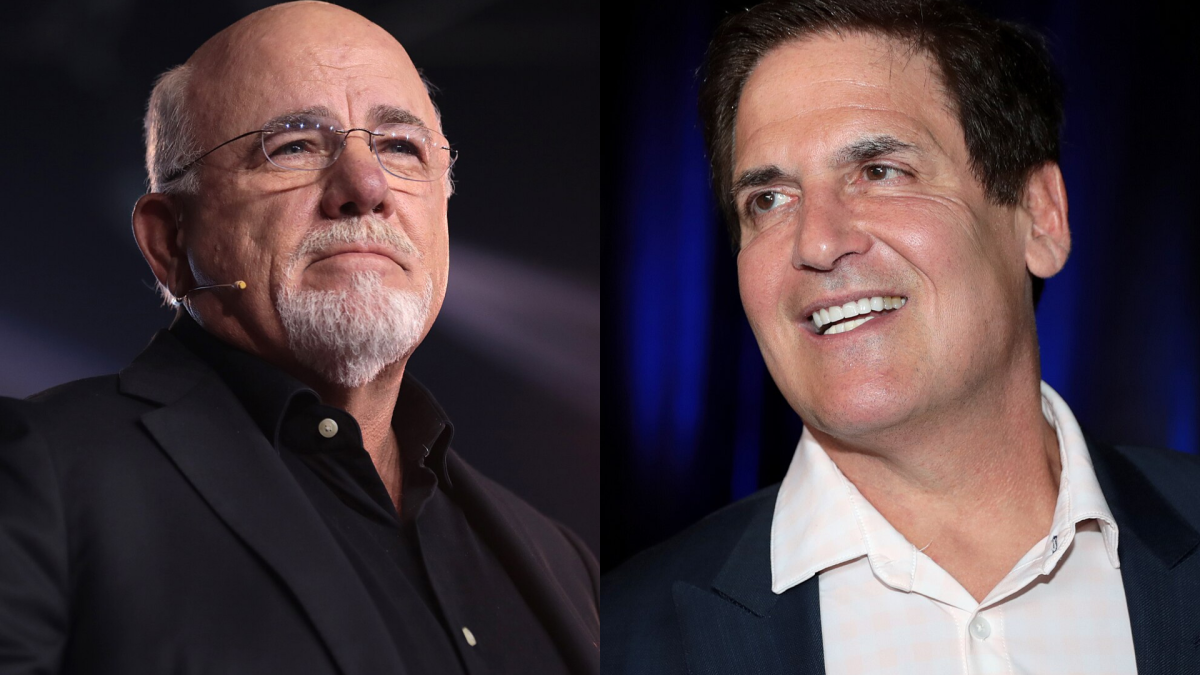

3 things Mark Cuban & Dave Ramsey agree on about personal finance

PositiveFinancial Markets

Mark Cuban and Dave Ramsey, despite their differing backgrounds and political views, find common ground on three key principles of personal finance. Their agreement highlights the importance of financial literacy and responsible money management, which can empower individuals to make informed decisions about their finances. This collaboration between two influential figures underscores that, regardless of differing opinions, there are fundamental truths in managing money that everyone can benefit from.

— Curated by the World Pulse Now AI Editorial System