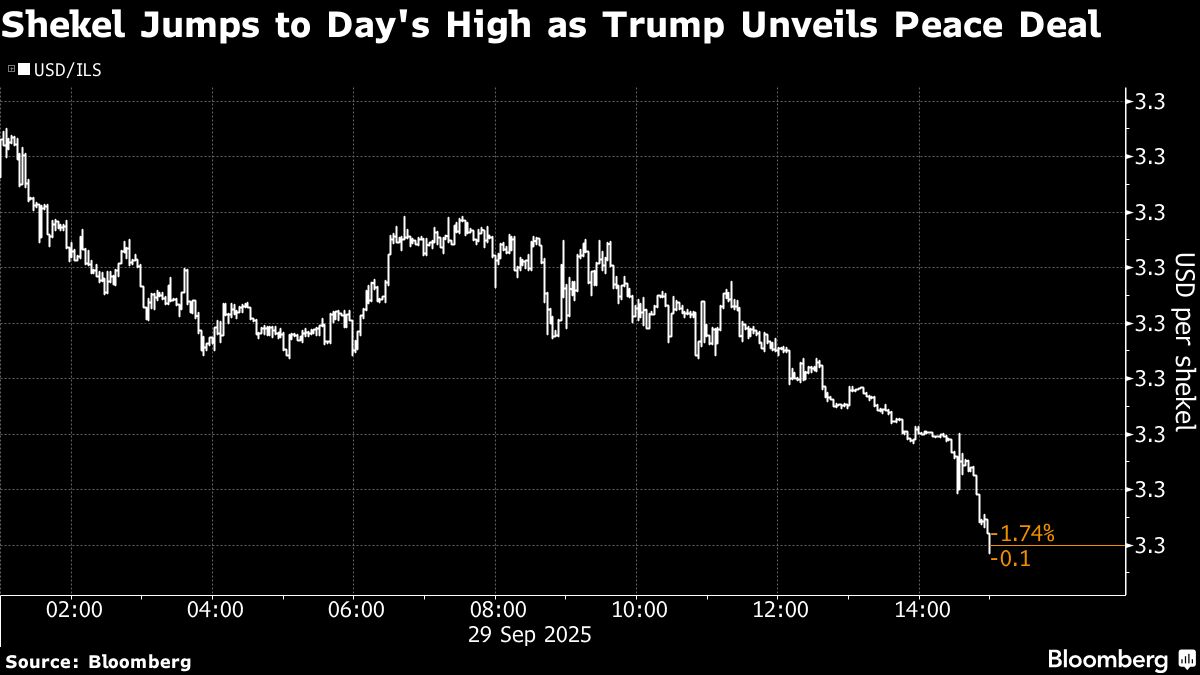

Israeli Stocks Rise to Record After Trump Unveils Gaza Plan

PositiveFinancial Markets

Israeli stocks have surged to a record high, marking their fifth consecutive quarterly rally. This rise comes as investors are optimistic about a 20-point plan put forth by Prime Minister Benjamin Netanyahu and US President Donald Trump, which they believe could expedite the resolution of the ongoing conflict in Gaza. This development is significant as it reflects investor confidence and the potential for stability in the region.

— Curated by the World Pulse Now AI Editorial System