Earnings call transcript: State Street Q3 2025 beats expectations, shares dip

NeutralFinancial Markets

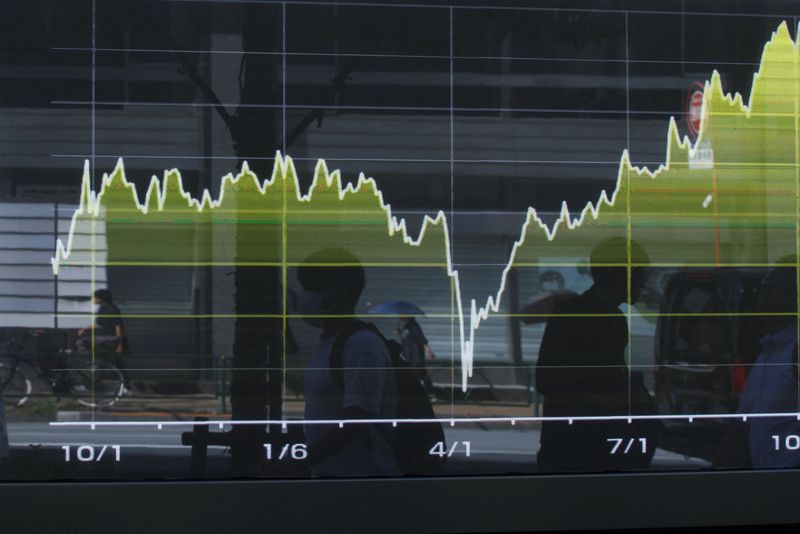

State Street's Q3 2025 earnings call revealed results that exceeded analysts' expectations, showcasing the company's strong performance in a challenging market. However, despite the positive earnings report, shares dipped, raising questions about investor sentiment and future growth prospects. This situation highlights the complexities of market reactions, where good news can sometimes lead to unexpected outcomes.

— Curated by the World Pulse Now AI Editorial System