ECB’s Next Move More Likely to Be Cut Than Hike, Villeroy Says

PositiveFinancial Markets

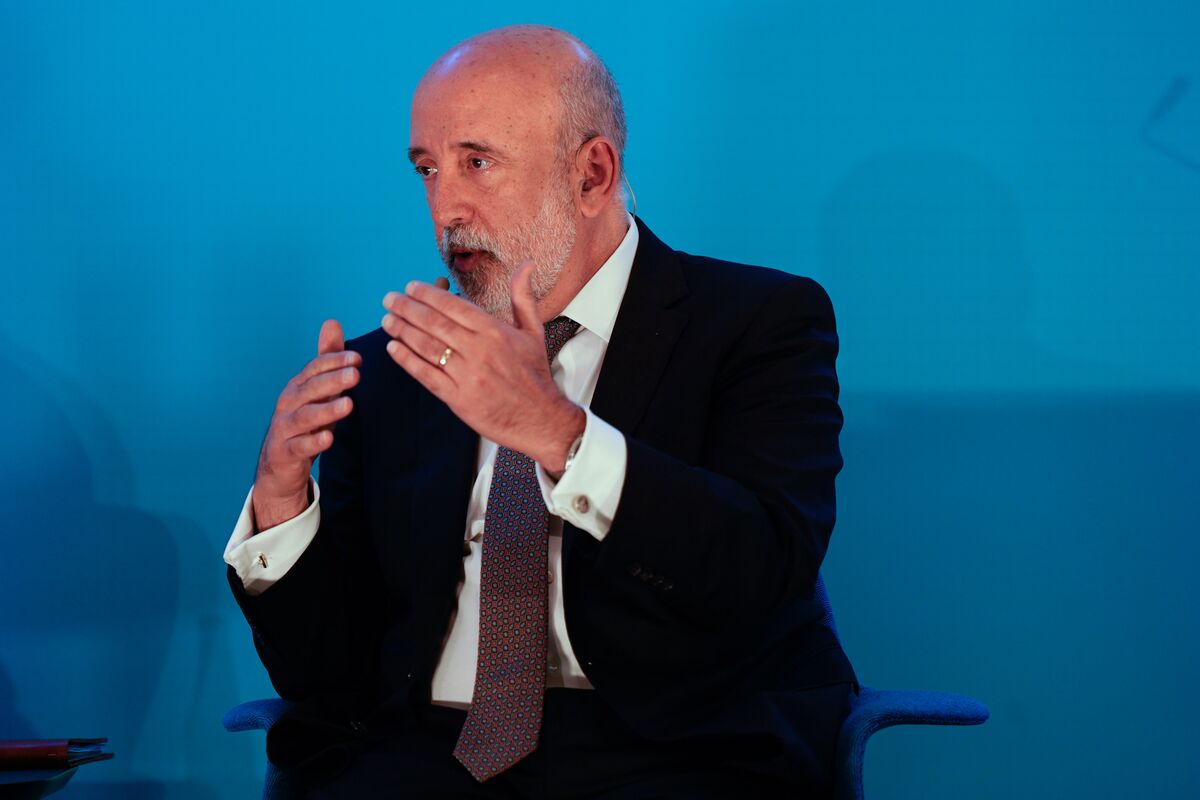

Francois Villeroy de Galhau, a member of the European Central Bank's Governing Council, has indicated that the bank is more inclined to cut interest rates rather than increase them in its upcoming decisions. This shift could signal a more supportive monetary policy aimed at stimulating economic growth, which is crucial for businesses and consumers alike.

— Curated by the World Pulse Now AI Editorial System