Bubble Can Push S&P 500 to 9,000 By End of 2026: Emanuel

PositiveFinancial Markets

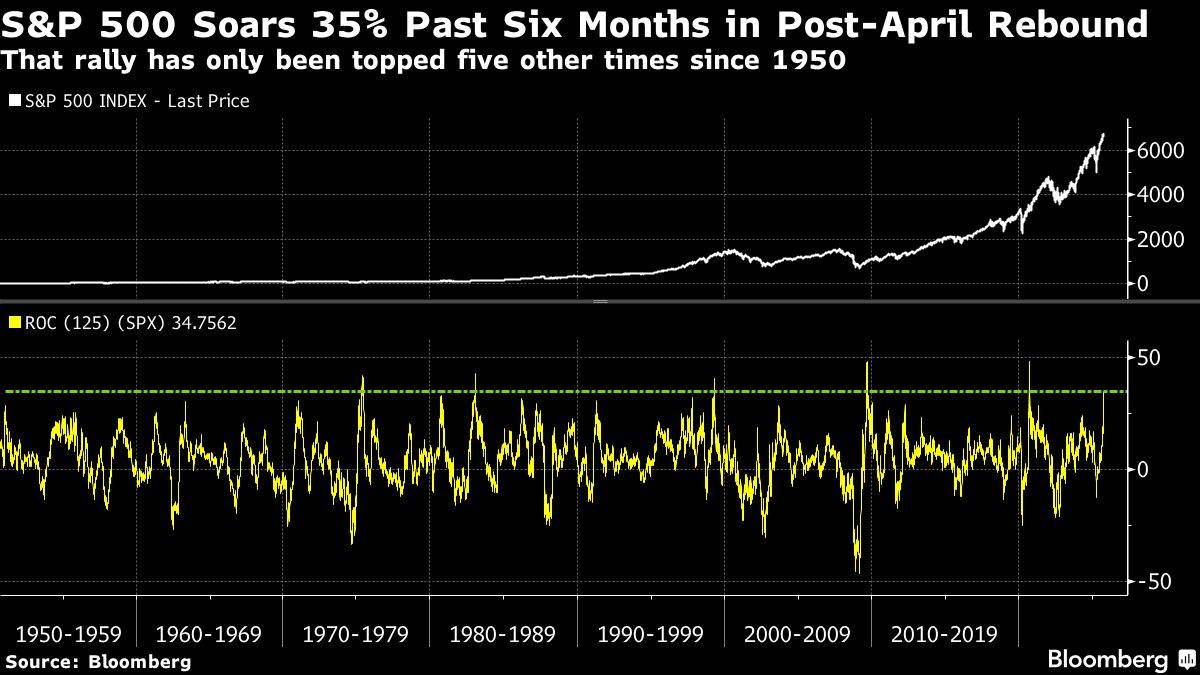

Julian Emanuel, the chief equity and quantitative strategist at Evercore ISI, suggests that there's a 30% chance of a bubble scenario pushing the S&P 500 to an impressive 9,000 by the end of 2026. This optimistic outlook highlights the potential for significant market growth, which could attract investors and boost confidence in the economy. Understanding these predictions is crucial for anyone looking to navigate the financial landscape in the coming years.

— Curated by the World Pulse Now AI Editorial System