Credit Market Has Been Aggressive All Year, Sheets Says (Video)

NeutralFinancial Markets

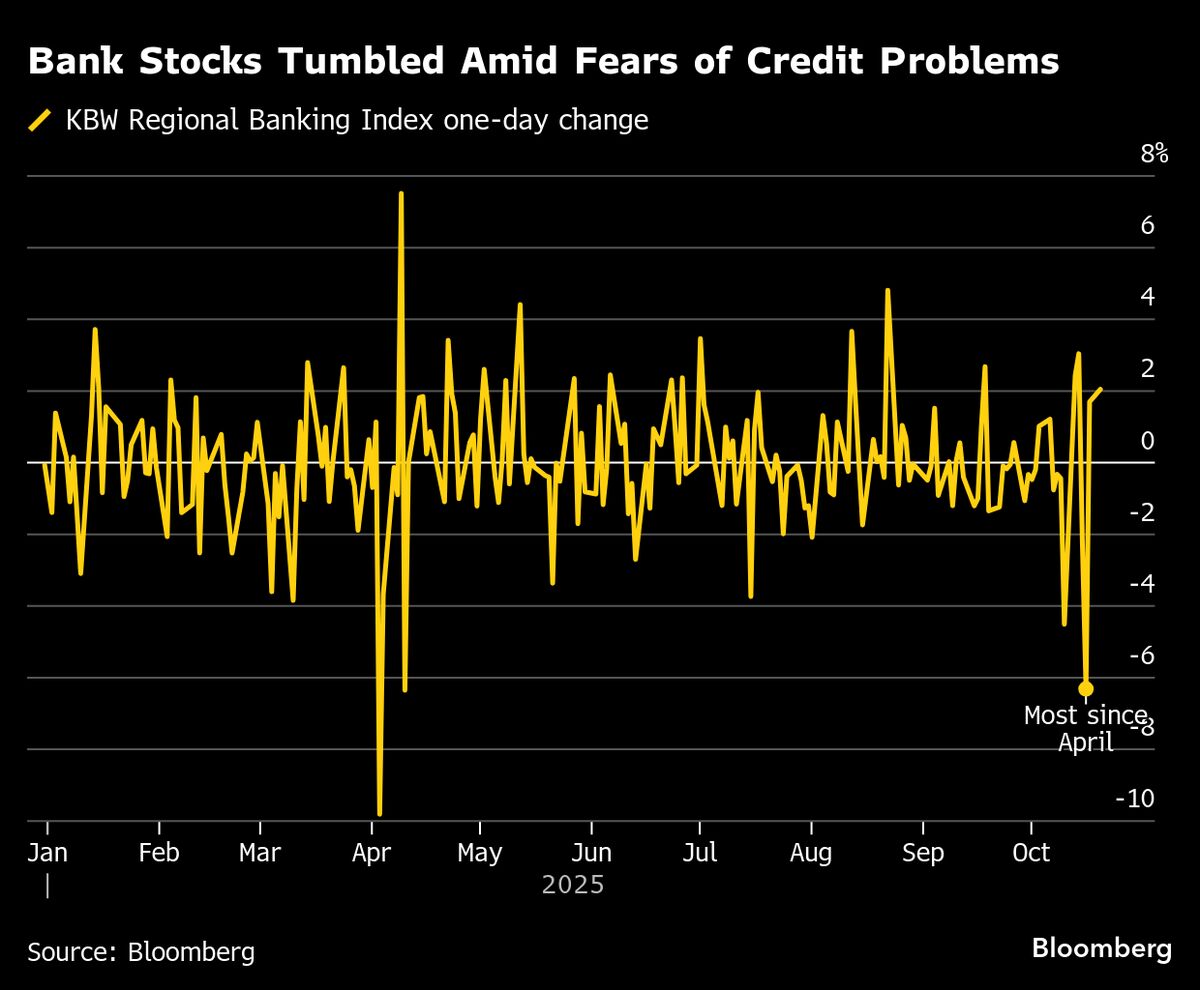

The credit market has shown aggressive trends throughout the year, as highlighted by Sheets in a recent video. This is significant because it reflects the ongoing dynamics in lending and borrowing, which can impact businesses and consumers alike. Understanding these trends helps stakeholders navigate the financial landscape more effectively.

— Curated by the World Pulse Now AI Editorial System