Berkshire’s Quarterly Earnings Rise After Insurance Results Bounce Back

PositiveFinancial Markets

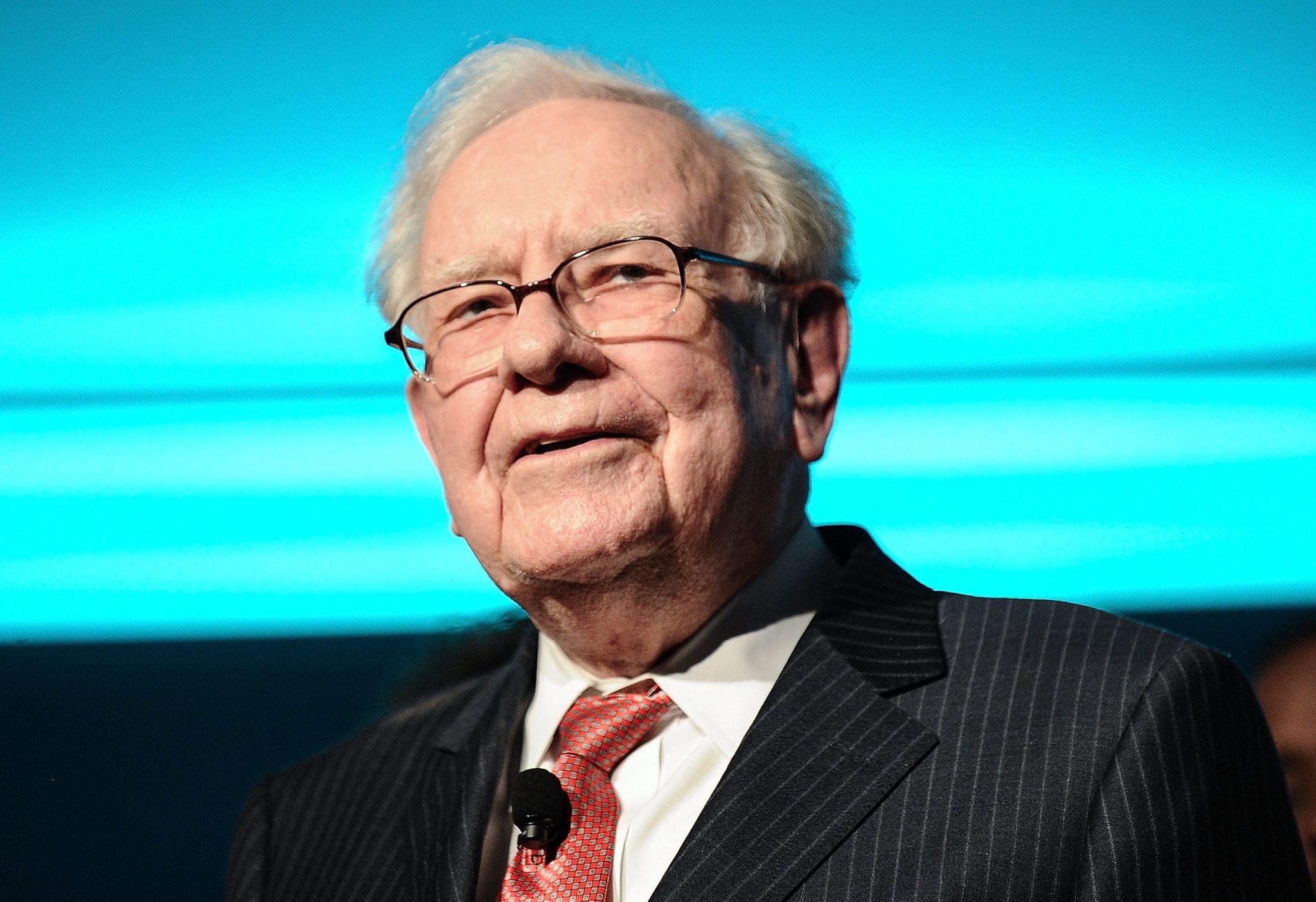

Berkshire Hathaway has reported a significant rise in quarterly earnings, largely driven by a rebound in its insurance results. This positive performance brings the company closer to a pivotal moment as Warren Buffett approaches retirement. With a record cash pile, Berkshire is well-positioned for future investments and growth, making this news important for investors and the market.

— Curated by the World Pulse Now AI Editorial System