Rising Debt, Stock Valuations: These Charts Haunt Wall Street

NeutralFinancial Markets

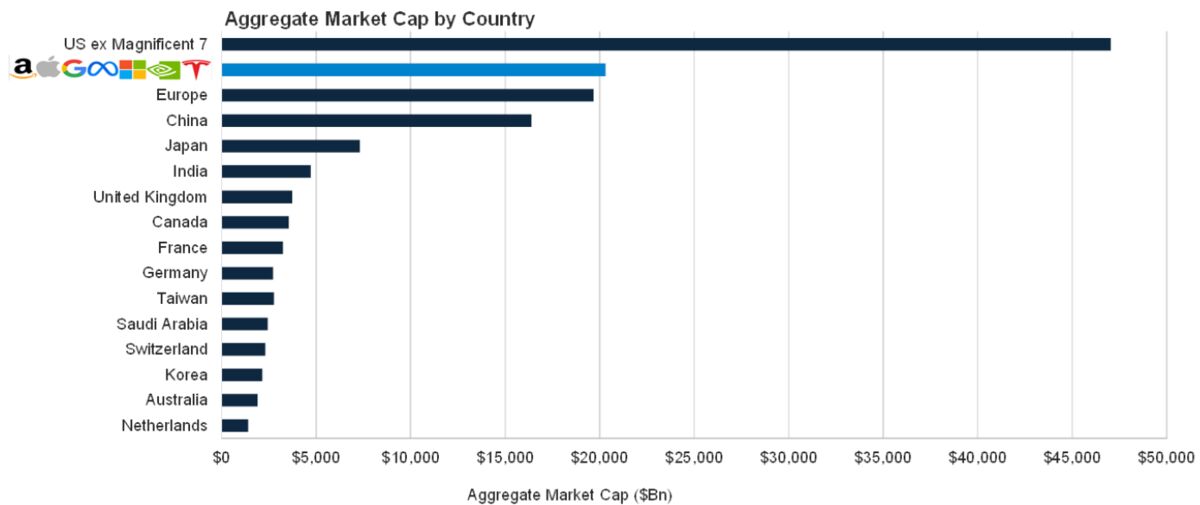

US stocks are currently near all-time highs, thanks to easing trade tensions between the US and China, which has allowed corporate America to largely ignore tariff pressures. However, this optimistic outlook doesn't mean that Wall Street professionals are feeling secure, especially with rising debt and stock valuations looming over the market. It's a complex situation that highlights the delicate balance between growth and potential risks.

— Curated by the World Pulse Now AI Editorial System