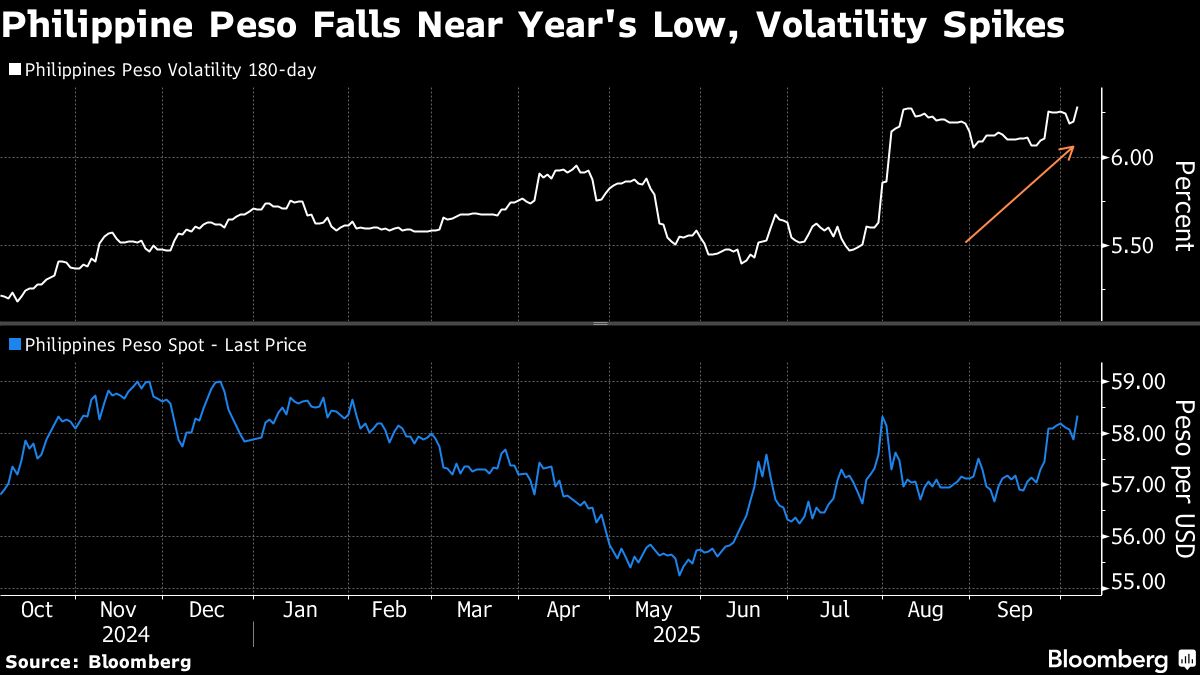

Philippine Peso Poised to Rebound on BSP Support, Analysts Say

PositiveFinancial Markets

Analysts are optimistic about the Philippine peso's potential rebound, anticipating that support from the Bangko Sentral ng Pilipinas (BSP) and seasonal remittance inflows will help stabilize the currency. This is significant as the peso has been one of Asia's weakest performers, and a recovery could positively impact the economy and boost investor confidence.

— Curated by the World Pulse Now AI Editorial System