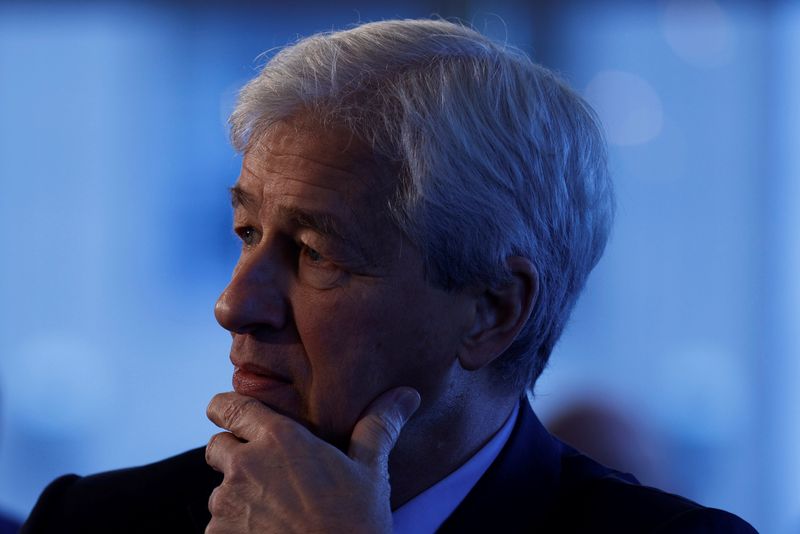

JPMorgan CEO says its exposure to collapsed auto dealer Tricolor "not our finest moment"

NegativeFinancial Markets

JPMorgan's CEO recently acknowledged that the bank's involvement with the collapsed auto dealer Tricolor was not their best decision. This admission highlights the challenges financial institutions face when dealing with volatile sectors like automotive sales. The situation is significant as it raises questions about risk management and the impact of such failures on the bank's reputation and future investments.

— Curated by the World Pulse Now AI Editorial System