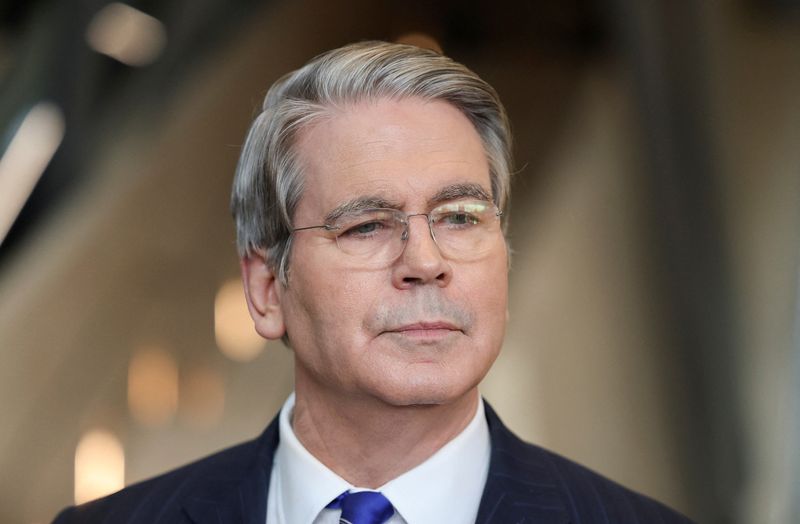

US Treasury’s Bessent calls for ’sound’ monetary policy in Japan

PositiveFinancial Markets

In a recent statement, US Treasury official Bessent emphasized the importance of maintaining a 'sound' monetary policy in Japan. This call comes at a crucial time as Japan navigates economic challenges, and Bessent's insights could influence future financial strategies. A stable monetary policy is vital for fostering economic growth and stability, not just in Japan but globally, making this discussion particularly relevant.

— Curated by the World Pulse Now AI Editorial System