Bessent’s Intervention in Argentine Peso Soars Past $1 Billion

PositiveFinancial Markets

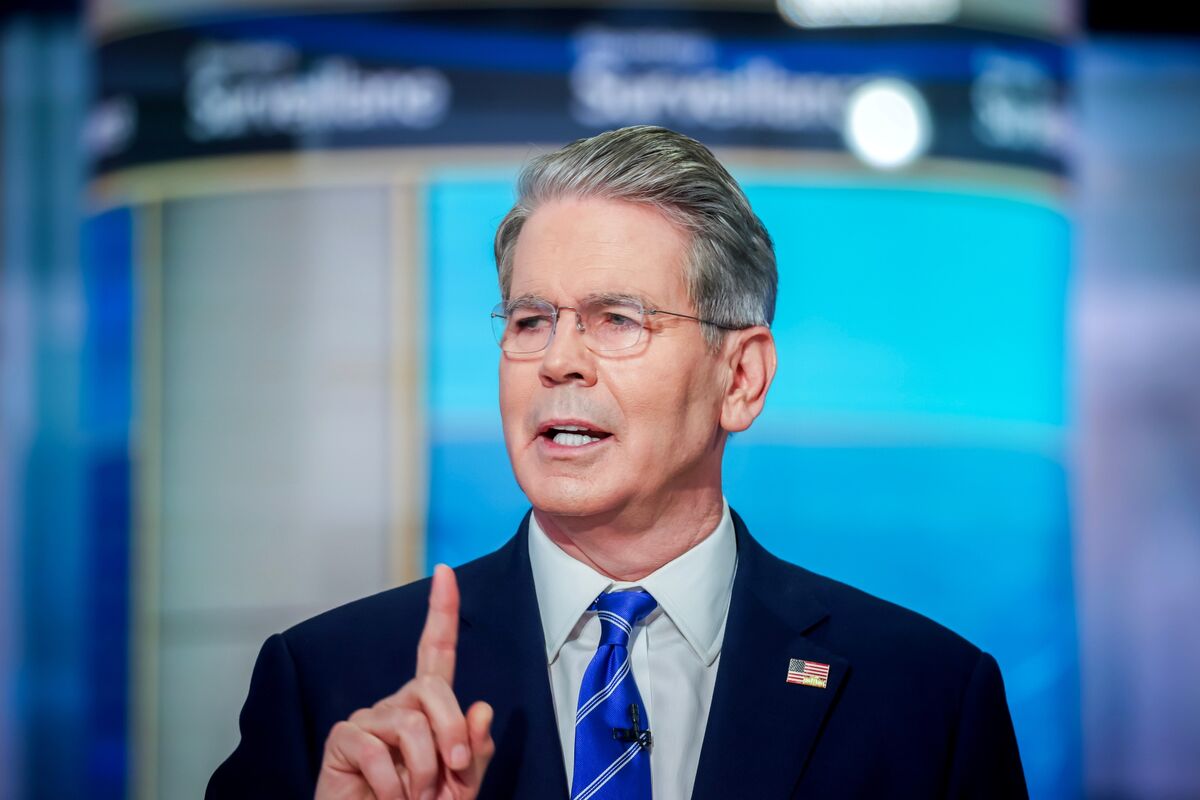

The US government's recent intervention in the Argentine peso has exceeded $1 billion, showcasing a significant commitment to stabilizing the currency ahead of the upcoming midterm elections on October 26. This move by Treasury Secretary Scott Bessent is crucial as it aims to bolster confidence in the Argentine economy during a politically sensitive time, highlighting the importance of international support in times of financial uncertainty.

— Curated by the World Pulse Now AI Editorial System