Markets Brace for the Costs of a Shutdown

NegativeFinancial Markets

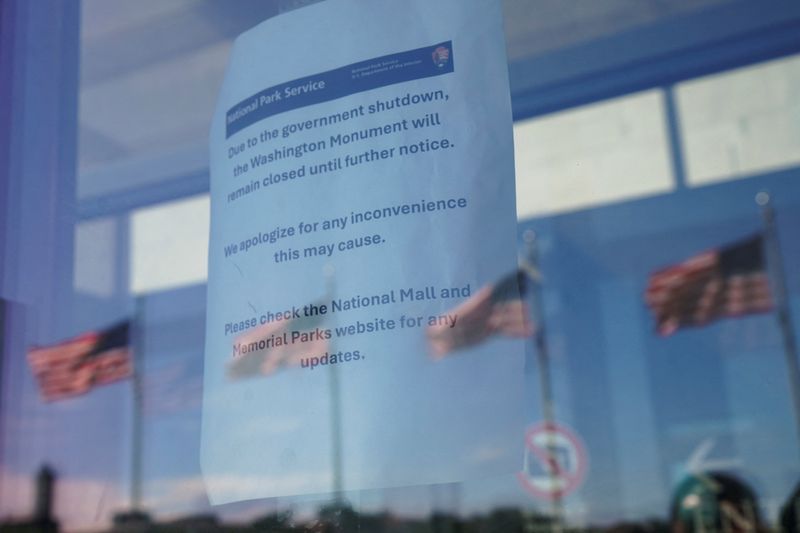

As the threat of a government shutdown looms, markets are on edge due to the potential economic fallout. Investors are particularly concerned about an economic data blackout and delays in initial public offerings (I.P.O.s), which could lead to increased volatility. The estimated cost of the shutdown could reach $400 million a day, making it a significant issue for the economy. This situation matters because it could impact investor confidence and market stability.

— Curated by the World Pulse Now AI Editorial System