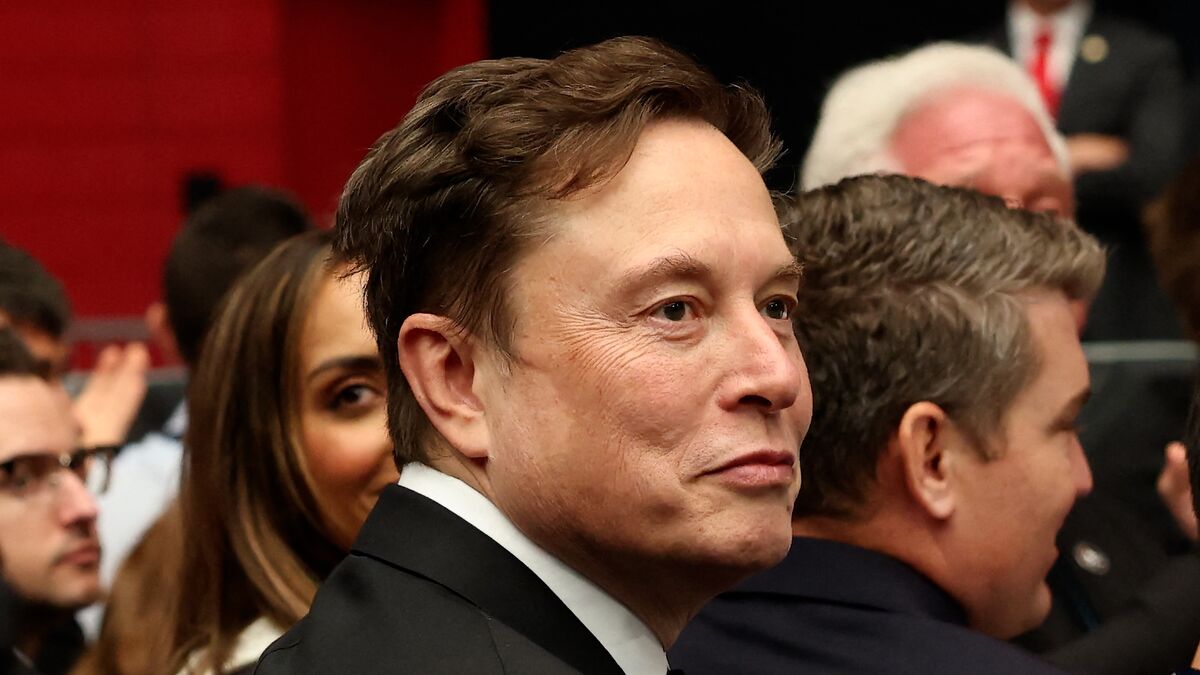

Musk Hijacks Tesla Earnings Call to Vouch for $1 Trillion Pay Plan

NeutralFinancial Markets

Elon Musk took center stage during Tesla's earnings call, urging investors to back his ambitious $1 trillion pay package while criticizing shareholder advisory firms. His comments shifted the focus from Tesla's advancements in artificial intelligence and robotics to the upcoming vote on his compensation plan at the annual meeting on November 6. This moment is significant as it highlights Musk's influence over the company and raises questions about corporate governance and shareholder power.

— Curated by the World Pulse Now AI Editorial System