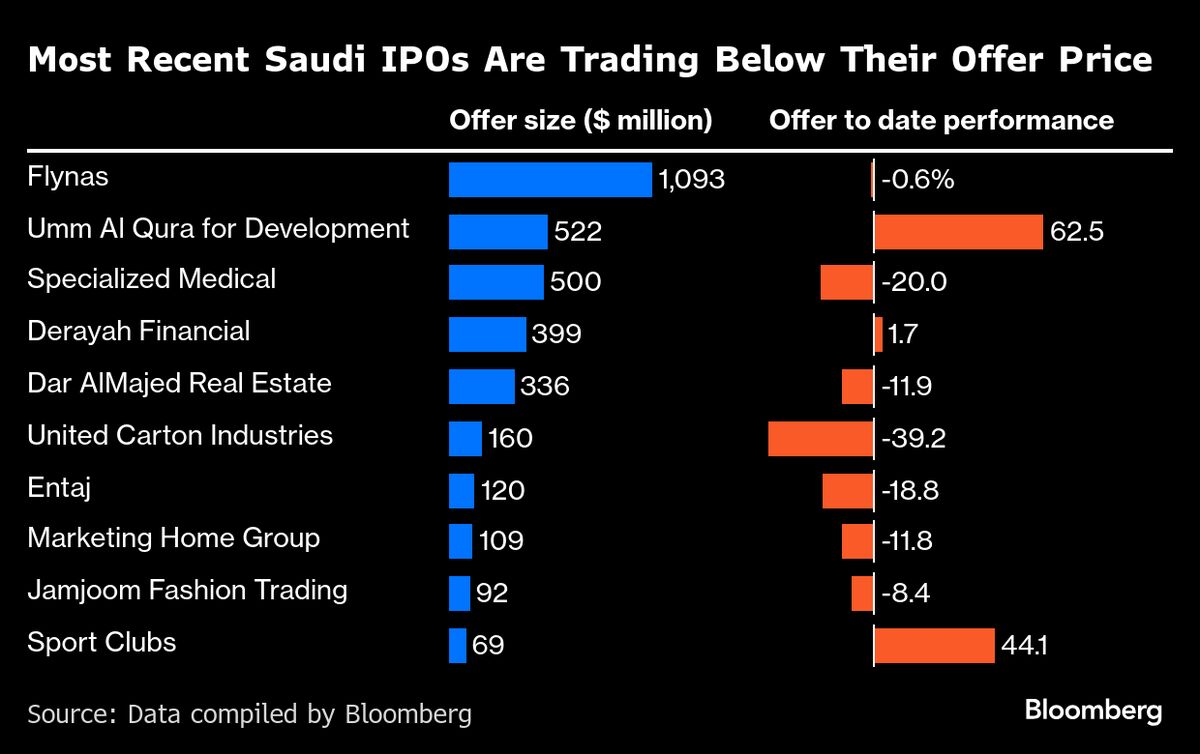

Riyadh Looks to Cool Property Surge to Lure Expats From Dubai

PositiveFinancial Markets

Saudi Arabia is taking significant steps to revamp its real estate market, aiming to attract expatriates from Dubai. Crown Prince Mohammed bin Salman is addressing the property crunch in Riyadh, which has been a major obstacle in competing with the financial powerhouses of Dubai and Abu Dhabi. This initiative not only aims to enhance Riyadh's appeal but also reflects the kingdom's broader ambitions to diversify its economy and boost foreign investment.

— Curated by the World Pulse Now AI Editorial System