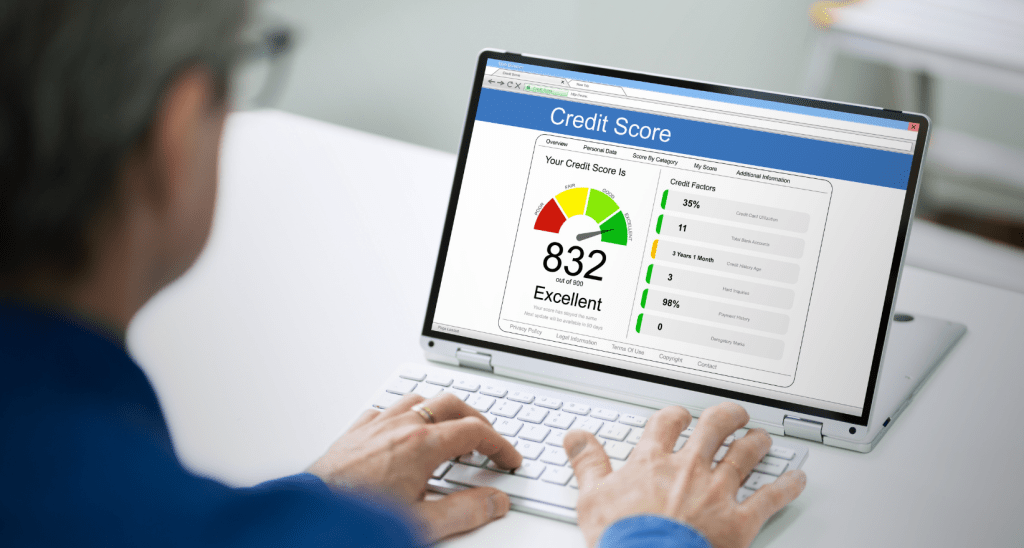

Student loan reporting changes could sabotage your credit scores

NegativeFinancial Markets

Recent changes in student loan reporting could negatively impact borrowers' credit scores, creating potential challenges for those managing their debt. This is significant because credit scores play a crucial role in determining loan eligibility and interest rates, affecting many individuals' financial futures.

— Curated by the World Pulse Now AI Editorial System