AI tools churn out ‘workslop’ for many US employees lowering trust | Gene Marks

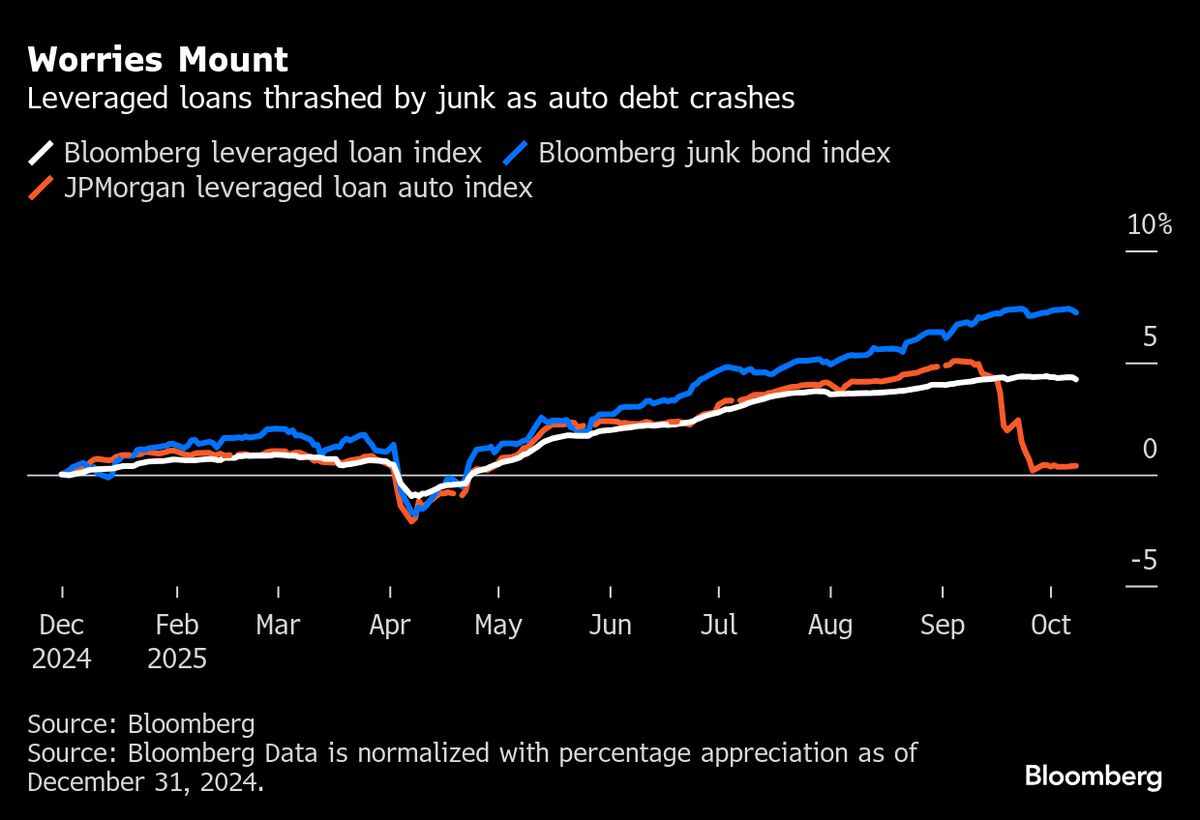

NegativeFinancial Markets

Recent studies reveal that many US employees are losing trust in AI tools due to widespread errors in the work produced. A survey by KPMG found that only 8.5% of respondents fully trust AI-generated results. This decline in confidence is concerning as it highlights the need for better training and oversight in using these technologies. As AI continues to integrate into workplaces, addressing these issues is crucial for maintaining productivity and employee morale.

— Curated by the World Pulse Now AI Editorial System