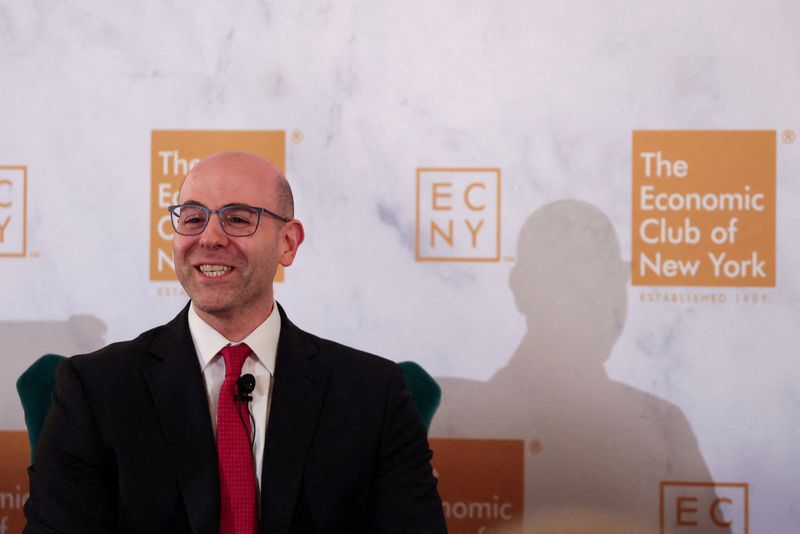

Bessent Says Some ‘Sectors’ Of Economy Are In Recession

NegativeFinancial Markets

Bessent has expressed concerns that certain sectors of the economy are currently in recession, attributing this downturn to the Federal Reserve's slow response in cutting interest rates. This situation is significant as it highlights the ongoing challenges faced by various industries and raises questions about the effectiveness of current monetary policy.

— Curated by the World Pulse Now AI Editorial System