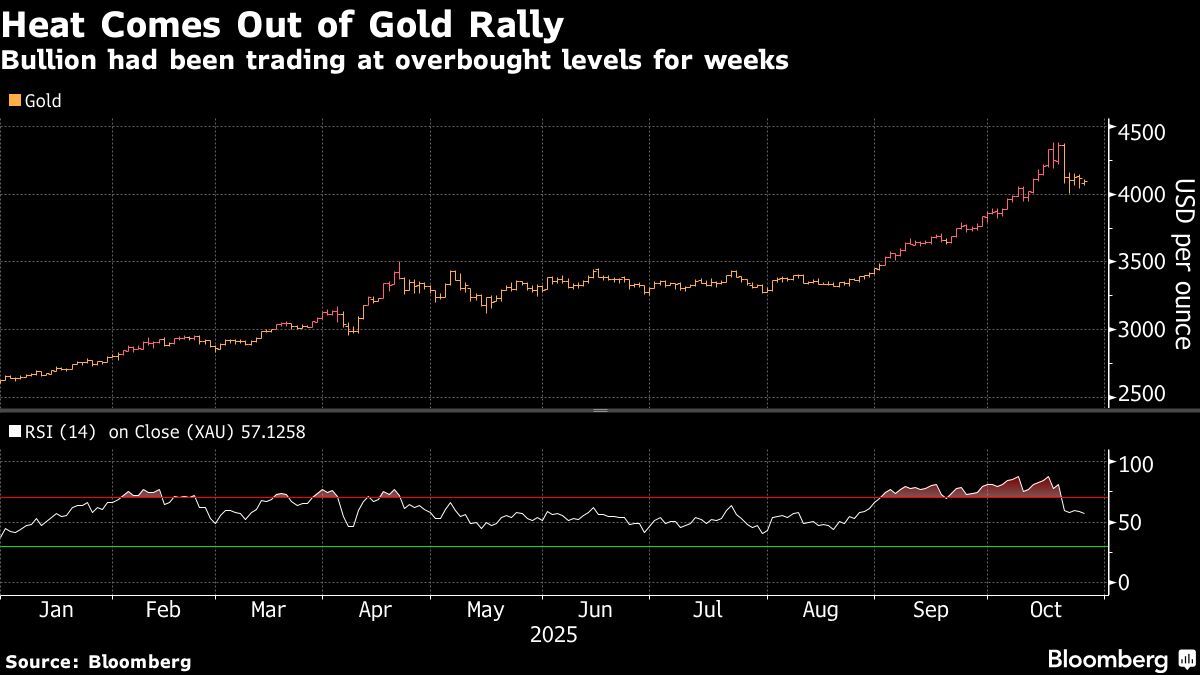

Gold Extends Drop as US-China Trade Progress Eases Haven Demand

NegativeFinancial Markets

Gold prices have taken a hit as the US and China move closer to a trade agreement, reducing the demand for gold as a safe haven. This marks the first weekly drop for gold since mid-August, indicating that the recent surge in precious metals may have been too rapid. This development is significant as it reflects changing market dynamics and investor sentiment, which could impact future trading strategies.

— Curated by the World Pulse Now AI Editorial System