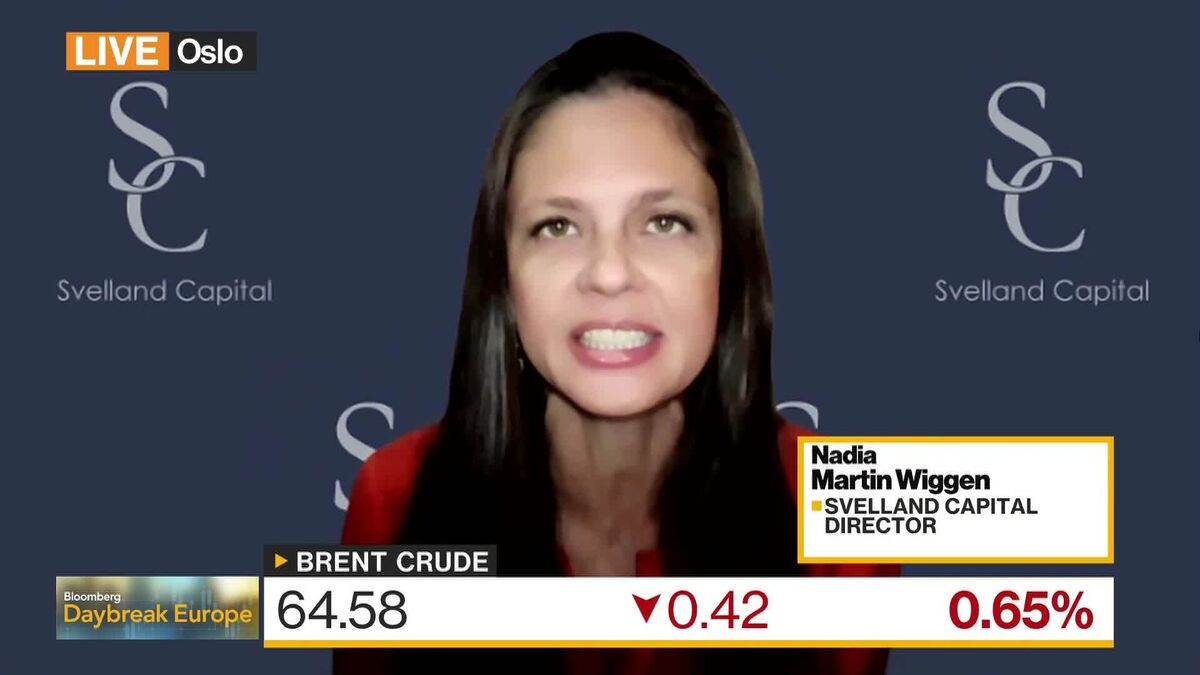

See Upside to Crude Prices: Svelland Capital’s Wiggen

NeutralFinancial Markets

Oil prices are facing a potential third consecutive monthly decline due to worries about a global oversupply. This comes as OPEC+ is anticipated to support another increase in supply during their upcoming meeting. Nadia Martin Wiggen from Svelland Capital shared insights on this situation during an interview with Bloomberg's Lizzy Burden on 'Daybreak Europe.' Understanding these dynamics is crucial as they can significantly impact global markets and economies.

— Curated by the World Pulse Now AI Editorial System