Trump sees ‘unprecedented opportunity’ to punish Democrats as shutdown enters day two

NeutralFinancial Markets

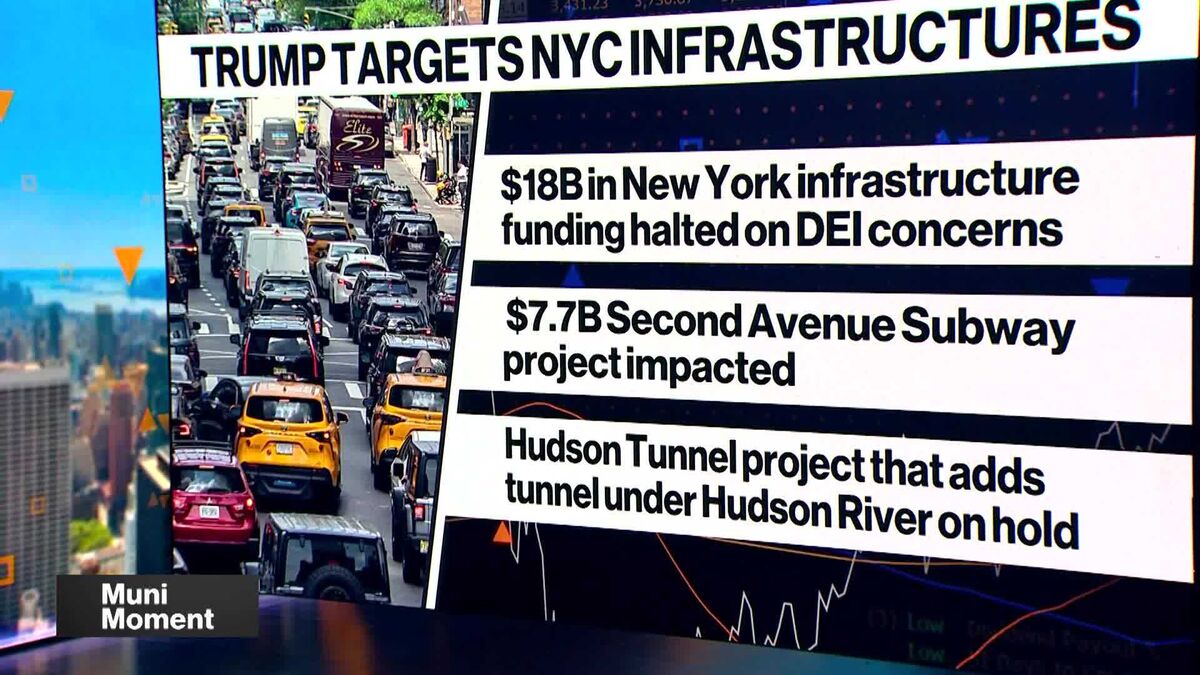

As the US government shutdown enters its second day, Donald Trump sees a unique chance to hold Democrats accountable. The ongoing standoff has sparked a heated exchange between Republicans and Democrats, with the White House leveraging the situation to implement cuts in government spending. This shutdown not only affects federal operations but also highlights the deepening political divide in the country, making it a significant moment in US politics.

— Curated by the World Pulse Now AI Editorial System