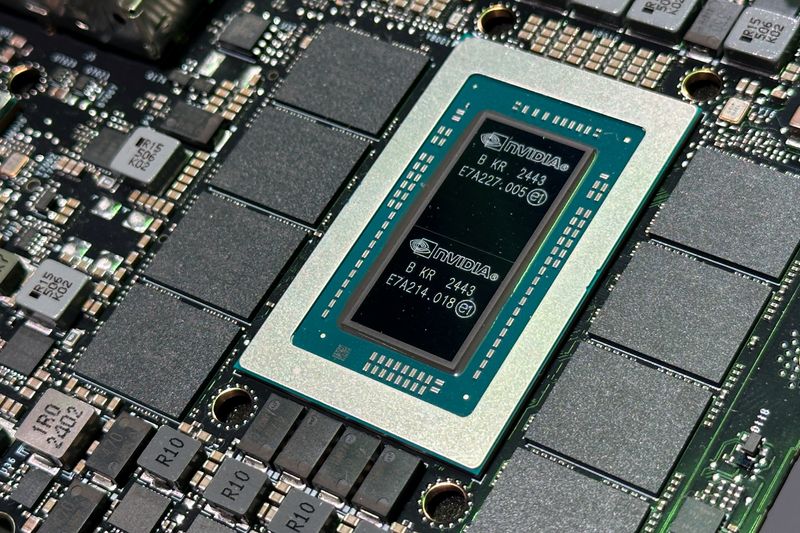

Celestica Q3 2025 slides: AI-driven growth propels 31% revenue outlook for 2026

PositiveFinancial Markets

Celestica has reported a promising outlook for 2026, projecting a 31% increase in revenue driven by advancements in AI technology. This growth highlights the company's strategic focus on integrating AI into its operations, which not only enhances efficiency but also positions Celestica as a leader in the tech industry. Investors and stakeholders should take note, as this positive trend could lead to significant opportunities for the company and its partners.

— Curated by the World Pulse Now AI Editorial System